Abderrahmane Lahlou

Expert in Participative Finance, ABWAB Consultants

Date: 2nd April 2019

Venue: Sheraton Casablanca Hotel & Towers, Casablanca

Attendees: 277

Speakers: 20 Speakers

The participation finance (Islamic finance) industry is poised for growth in Morocco. Initiated back in 2014 with the vote of the participation finance bill, the development of an exhaustive regulatory framework aiming to accommodate all aspects of participation finance in Morocco reached a whole new level in 2017 when the eight banks that were granted licenses in January were finally allowed – seven months later – to offer Shariah compliant products.

By developing a full set of regulations accommodating all aspects of the participation finance industry, the Kingdom has come a long way where participation finance is concerned. For participation banks, the top priority is certainly the introduction of Takaful but some market players have mentioned the need for an Islamic asset management industry while others are calling for the Casablanca Stock Exchange to be equipped with an Islamic equity index.

09:10 – 09:15

Welcome Remarks

09:15 – 09:30

Welcome Address & Market Overview

09:30 – 10:30

The Big Picture: Formalizing the Islamic Finance, Banking and Takaful Ecosystem in Morocco

We assess the steps the Kingdom has taken to facilitate the Islamic finance ecosystem over the past year and ask how successful these measures have been. We discuss the introduction of the benchmark Sukuk in 2018, the initiation of the local Takaful market as well as the introduction of REITs and other investment management structures. We also discuss opportunities and challenges facing domestic Islamic banks, including successfully growing deposit bases and effectively managing liquidity.

Moderator:Said Amaghdir, Chairman, Moroccan Association for Participative Finance Professionals – Shariah Compliant (AMFP) and Director of Takaful projects, SAHAM Assurance

Panelists:Hounaida Boukhari, Managing Director, Dar Al Amane

Ghizlane Rabhi, Moroccan Capital Market Authority

Ikhlas Mettioui, Head of Asset Management, Moroccan Capital Market Authority

Mohamed Maarouf, General Manager, BTI Bank

Nabil Lemrazi, CEO, Universites Des Savoirs Connectes

Youssef Baghdadi, CEO, Bank Assafa

10:30 – 11:00

Coffee & Networking

11:00 – 12:00

Sukuk, Capital Markets and Asset Management

Will the recent sovereign Sukuk enable the expansion of the Moroccan sovereign, sub-sovereign and private sector Sukuk market in support of the national development plan? What does the sovereign mean for the local market and what investment and liquidity management opportunities does it offer domestic Islamic banks? Through an expert panel we analyze product structures, the securitization regulatory framework, ratings, structuring issues and the use of SPVs in asset transfer and ownership. We also discuss the recent launch of the Moroccan Islamic Equity Index and discuss opportunities for local capital market participants and asset managers.

Moderator:Zaineb Sefiani, Founder, Carrera Learning

Panelists:Badr Benyoussef, Chief Business Development Officer, Casablanca Stock Exchange

Monsif Ghaffouli, CIO, Wafa Gestion

Noreddine Tahiri, CEO, AjarInvest

Yassine Temli, Managing Partner, Maghreb Capital Advisors

12:00 – 12:20

Presentation: REIT — New Investment Opportunity for Morocco

Mehdi Bouamama, Head of Acquisitions at Morocco REIT Management

12:20 – 12:40

Presentation: How Appealing is Participative Insurance - known as Takaful - to Moroccans?

Simohammed Bellamine, Marketing and Strategy Consultant

12:40 – 13:35

Launch and Development of The Takaful Industry in Morocco

We take a comprehensive look at the nascent domestic Takaful market, identifying challenges and asking how they can be overcome. What is the current status of the Takaful industry in terms of regulation, awarding of licenses, market readiness, product offerings and potential market penetration?

Moderator:Ahmed Tahiri Jouti, COO, Al Maali Consulting Group

Panelists:Abderrahmane Lahlou, Expert in Participative Finance, ABWAB Consultants

Hakim Bensaid, Project Manager, Participative Insurance – Takaful, RMA Assurance and Vice-Chairman, AMFP

Koudama Zeroual, Directeur Général Assurances Takaful, Wafa Assurance

Mohammed Amine Sabibi, Research Fellow, Economia Research Center

Shaima Hasan, Research and Product Development Manager, Refinitiv

13:35

Closing Remarks & End of Forum

13:35

Luncheon

14:30 – 16:30

The IFN Morocco Dialogue

Now in its fourth year, the highly acclaimed IFN Dialogue will once again bring together a select group of Morocco’s leading Islamic finance practitioners and regulators to openly discuss the benefits and concerns facing the Shariah compliant financing and investment market today.

This thought-provoking exclusive closed-door session will consist of local regulators, industry practitioners and key international players with a solid understanding of the local market but with an outsider’s point of view.

Mehdi Bouamama, Head of Acquisitions at Morocco REIT Management

Ahmed Tahiri Jouti

COO, Al Maali Consulting Group

Badr Benyoussef

Chief Business Development Officer, Casablanca Stock Exchange

Ghizlane Rabhi

Moroccan Capital Market Authority

Hakim Bensaid

Project Manager, Participative Insurance – Takaful, RMA Assurance and Vice-Chairman, AMFP

Hounaida Boukhari

Managing Director

Dar Al Amane

Ikhlas Mettioui

Head of Asset Management

Moroccan Capital Market Authority

Koudama Zeroual

Directeur Général Assurances Takaful, Wafa Assurance

Mehdi Bouamama

Head of Acquisitions at Morocco REIT Management

Mohammed Amine Sabibi

Research Fellow, Economia Research Center

Monsif Ghaffouli

CIO, Wafa Gestion

Mohamed Maarouf

General Manager

BTI Bank

Nabil Lemrazi

CEO, Universites Des Savoirs Connectes

Noreddine Tahiri

CEO, AjarInvest

Said Amaghdir

Chairman, Moroccan Association for Participative Finance Professionals – Shariah Compliant (AMFP) and Director of Takaful projects, SAHAM Assurance

Shaima Hasan

Research and Product Development Manager

Refinitiv

Simohammed Bellamine

Marketing and Strategy Consultant

Yassine Temli

Managing Partner

Maghreb Capital Advisors

Youssef Baghdadi

CEO

Bank Assafa

Zaineb Sefiani

Founder, Carrera Learning

Ahmed Tahiri Jouti

Chief Operating Officer

Al Maali Consulting Group

Ali Alami Idrissi

General Manager

Optima Finance Consulting

Anouar Hassoune

Managing Director

Euris Group

Fouad Harraze

Director General

Al Akhdar Bank

Hamza Boukili

Senior Associate, Line of Finance Division – FIDD

The Islamic Corporation for the Development of the Private Sector

Hounaida Boukhari

Managing Director

Dar Al Amane

Koudama Zeroual

Directeur Général Assurances Takaful, Wafa Assurance

Mohammad Farrukh Raza

Managing Director

IFAAS

Mohammed Amine Sabibi

Financial Consultant and Coordinator of the Executive Master Principles and Practices of Islamic Finance, Casablanca, University Paris-Dauphine

Mohamed Maarouf

General Manager

BTI Bank

Said Amaghdir

Chairman, Moroccan Association for Participative Finance Professionals – Shariah Compliant (AMFP) and Director of Takaful projects, SAHAM Assurance

Yassine Temli

Managing Partner

Maghreb Capital Advisors

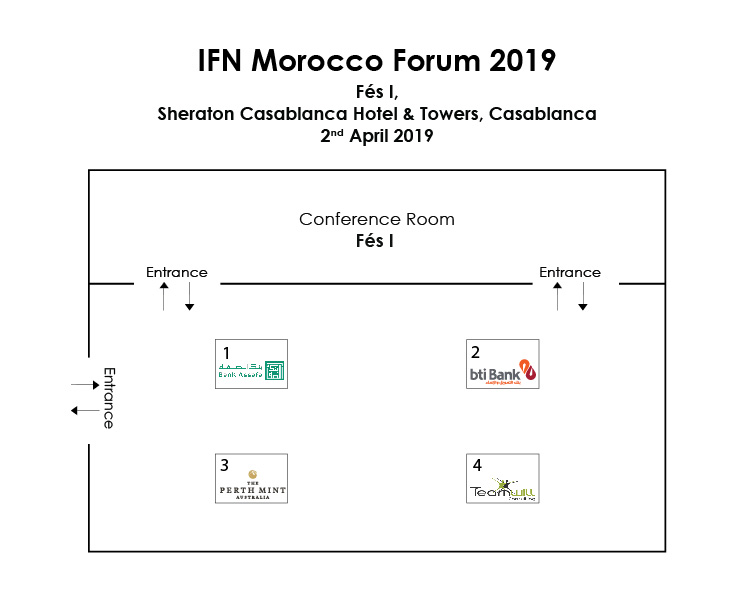

FORUM SPONSORS

MULTILATERAL STRATEGIC PARTNERS

PARTNERS

MEDIA PARTNERS

Last Visit to Casablanca

The participation finance (Islamic finance) industry is poised for growth in Morocco. Initiated back in 2014 with the vote of the participation finance bill, the development of an exhaustive regulatory framework aiming to accommodate all aspects of participation finance in Morocco reached a whole new level in 2017 when the eight banks that were granted licenses in January were finally allowed – seven months later – to offer Shariah compliant products. This major milestone was preceded by the inauguration of the banks’ network of branches dedicated to participation finance activities, particularly throughout the first half of the year.

By developing a full set of regulations accommodating all aspects of the participation finance industry, the Kingdom has come a long way where participation finance is concerned. For participation banks, the top priority is certainly the introduction of Takaful but some market players have mentioned the need for an Islamic asset management industry while others are calling for the Casablanca Stock Exchange to be equipped with an Islamic equity index.

Following a successful edition in 2017, IFN Morocco Forum returns to Casablanca in April 2018 to provide industry players with an invaluable chance to explore the potential of this nascent yet promising market.

Dr Abderrahmane 2017

IFN Forum Morocco was a timely opportunity for the main participative finance actors to share with the public the latest developments of the industry.

Abdessamad Issami 2017

The IFN event gathered the participative finance professionals and updated them through very useful interactions on different subjects.

Dr Ahmed Tahiri 2017

IFN Forum Morocco 2017 was a successful event that gathered the main local players and some prominent international experts to discuss the perspectives and to give an insight about the challenges facing the Islamic finance industry locally and globally. It is always interesting to be part of the IFN events for their punctuality and networking opportunities.

Hakim Bensaid 2017

In my view, the event was just a success story: it was well-organized and well-enriched with a special focus on the hot topics/issues. So, I would like to extend my wholehearted congratulations and appreciation to the event organizer and the whole working team.

For any inquiries contact us

Our team will be glad to answer any questions you may have about this event.