Abdulkadir Abbas

Deputy Director, Securities and Exchange Commission

Six Days 18th - 24th June 2019

Three Countries Nigeria, Kenya and South Africa

ONE CONTINENT Africa

Attendees 300

IFN African Roadshow 2019

Africa was the first continent into which Islam spread from SE Asia and is now home to almost one-third of the world’s Muslim population. Although interest in Islamic finance continues to spread across this diverse yet complex continent, it has remained a difficult market to penetrate. With this in mind, IFN will organize the inaugural IFN African Roadshow taking in three of the most likely markets to see Shariah compliant financing flourish in the coming years.

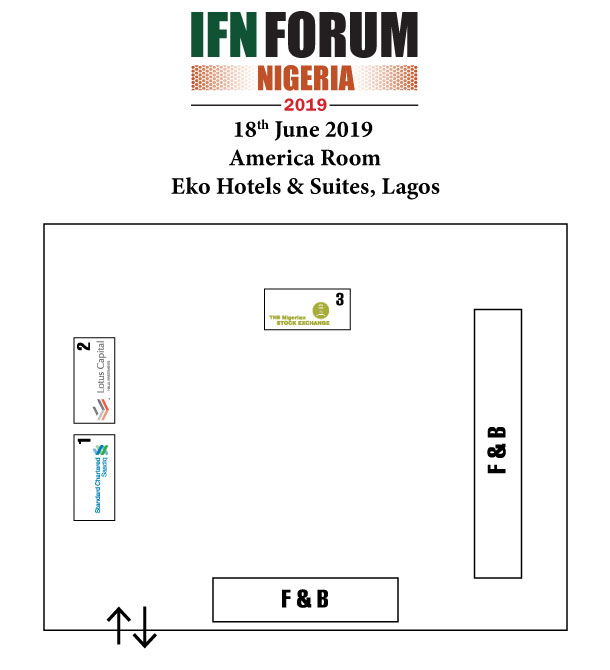

IFN NIGERIA FORUM 2019

With its Sukuk aspirations finally realized in 2017 and its only Islamic bank receiving an international operating license, Nigeria has a lot to offer to the global Islamic finance industry. The African nation has been steadily giving stiff competition to its neighbors like South Africa, Uganda and Djibouti on the Shariah front and with its debut sovereign Sukuk, Nigeria sealed its place at the top of the regional Islamic finance league.

On the 18th June 2019, join IFN as it convenes industry experts and decision-makers at its inaugural IFN Nigeria Forum to discuss the challenges and opportunities in the Nigerian Islamic finance market.

Date 18th June 2019

Venue Eko Hotels & Suites, Lagos

09:00

Welcome Address

Jude Chiemeka, Divisional Head, Trading Business, Nigeria Stock Exchange

09:15

Keynote Address

Harnessing the Islamic Finance Sector for Infrastructure Development and Economic Growth:

Abdulkadir Abbas, Deputy Director, Securities and Exchange Commission

09:35

Islamic Finance, Investment, Banking and Takaful in Nigeria

Nigeria is the second- largest OIC economy; nevertheless, the sustained low oil price has impacted its economy. With a growing Islamic finance sector and the stability of the gGovernment, there is immense potential for sustainable growth. Through a respected panel, we take a look at developments in regulation, banking, capital markets, investment management and Takaful and theits impact onto the Nigerian economy. In addition, we assess the success of its debut sovereign Sukuk and the opportunities for Islamic finance in the region.

Moderator:Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Panelists:Abdulkadir Abbas, Deputy Director, Securities and Exchange Commission

Jude Chiemeka, Divisional Head, Trading Business, Nigerian Stock Exchange

Patience Oniha, Director General, Debt Management Office

Umara Farouk Amina, Head, Research & Strategy Management, National Pension Commission

10:45

Interview

Interviewee: Patience Oniha, Director General, Debt Management Office

Interviewer: Marc Roussot, Senior Journalist and Multimedia Editor, Islamic Finance News

11:00

Coffee & Networking

11:30

Corporate Financing and Capital Raising in Nigeria: What does Islamic Finance offer?

We ask leading capital market professionals to discuss the prospects for domestic and regional capital and Sukuk markets in the coming months. What structures and asset classes will find favor with issuers and investors? We examine distribution, ratings and credit enhancement measures and identify other factors facing issuers in the Nigerian capital market. What challenges still exist within domestic taxation and regulatory frameworks and how can these be addressed? Finally, what do Sukuk offer West African sovereign, multilateral and supranational issuers?

Moderator:Adeola Sunmola, Partner, Udo Udoma & Belo Osagie

Panelists:Hajara Adeola, Managing Director/CEO, Lotus Capital

Oluseun Olatidoye, Head, Debt Capital Markets, FBNQuest Merchant Bank

Shuaib Audu, Executive Director, Stanbic IBTC Asset Management

Vivien Shobo, Managing Director, Agusto & Co

12:30

Recent Developments in International Islamic Financing and Sukuk Markets

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

12:45

Funding Infrastructure and Social Welfare Requirements in West Africa

We discuss public–private partnerships, financing structures as well as opportunities in active sectors.

Moderator:Jubril Salaudeen, COO, Citiserve

Panelists:Aig Imoukhuede, Head, Capital Markets Coronation Merchant Bank

Bashir Sharif Isyaku, Head, North-west Regional Tax Audit, Federal Inland Revenue Service, Kano

Ummahani Ahmad Amin, Principal Attorney, The Metropolitan Law Firm

13:30

Lunch & Networking

Adeola Sunmola

Partner, Udo Udoma & Belo Osagie

Ahsan Ali

Head of Islamic Origination, Standard Chartered Bank

Aig Imoukhuede

Head, Capital Markets Coronation Merchant Bank

Bashir Sharif Isyaku

Head, North-west Regional Tax Audit, Federal Inland Revenue Service, Kano

Hajara Adeola

Managing Director/CEO, Lotus Capital

Jubril Salaudeen

COO, Citiserve

Jude Chiemeka

Divisional Head, Trading Business, Nigerian Stock Exchange

Marc Roussot

Senior Journalist and Multimedia Editor, Islamic Finance News

Oluseun Olatidoye

Head, Debt Capital Markets, FBNQuest Merchant Bank

Patience Oniha

Director General, Debt Management Office

Shuaib Audu

Executive Director, Stanbic IBTC Asset Management

Umara Farouk Amina

Head, Research & Strategy Management, National Pension Commission

Ummahani Ahmad Amin

Principal Attorney, The Metropolitan Law Firm

Vivien Shobo

Managing Director, Agusto & Co

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Hajara Adeola

Managing Director/CEO, Lotus Capital

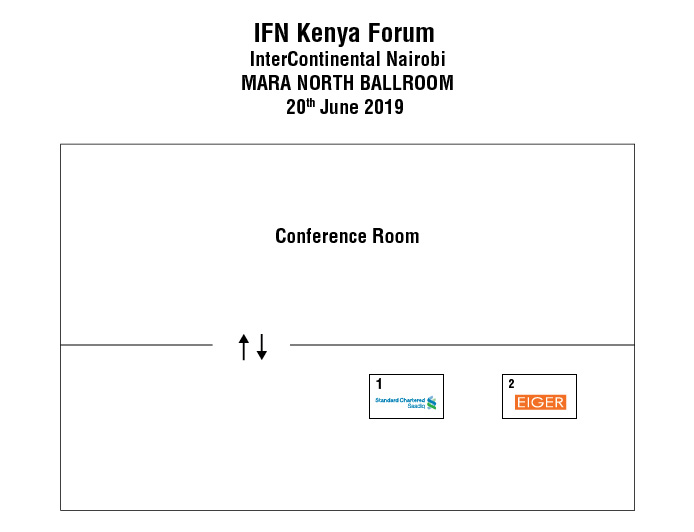

IFN KENYA FORUM 2019

Hailed as the new frontier for Islamic finance, Africa – where a quarter of the world’s Muslim population call home – is a land fertile with opportunities.

In recent years, the continent has seen promising developments in the Islamic finance space: country and regional authorities are pushing for new regulations to facilitate Shariah compliant transactions; new financial institutions offering Islamic products are emerging; foreign banks are establishing an African presence primarily to tap the Muslim population; and more African sovereigns are making their mark in the Sukuk space.

And it is truly an exciting time for Islamic finance in Kenya. On the back of this vibrant landscape, IFN is delighted to return to one of the fastest-growing Islamic finance markets in the region. The IFN Kenya Forum will gather leading market practitioners and regulators from across the region to discuss and debate the most pressing issues of the industry.

Date 20th June 2019

Venue InterContinental Nairobi

09:00

Welcome Remarks

09:30

Opportunities for Islamic Finance, Banking and Investment in Kenya and East Africa

We discuss key ideas, issues and themes influencing Islamic finance, banking and investment in Kenya and the region. What will offer opportunity and what will disrupt and what role will Islamic finance play in the development of social inclusion and the achievement of the UN Sustainable Development Goals in East Africa? What of new regulatory measures designed to boost domestic Islamic finance activity and what else is needed to grow capital markets, investment management, banking and Takaful?

Moderator:Tego Wolasa, Retail and Product Development Manager, KCB Sahl Bank

Panelists:Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Claire Matheson Kirton, Partner, White & Case

Justus Agoti, Senior Researcher, Capital Markets Authority

10:30

Coffee & Networking

11:00

Corporate Financing, Capital-Raising and Projects in Kenya: What does Islamic and Responsible Finance offer?

We ask a respected panel to discuss the prospects for domestic and regional capital and Sukuk markets. What structures and asset classes will find favor with issuers and investors? We examine key factors facing issuers and projects in the Kenyan and East African markets: what challenges still exist within domestic taxation and regulatory frameworks and how can these be addressed? What does Islamic finance offer East African sovereign, multilateral and supranational issuers as well as PPP [public–private partnership] and infrastructure projects? Finally, what are the opportunities for Islamic and ethical finance to fund and cooperate with sustainable and responsible projects in key sectors such as energy, education, healthcare and agriculture?

Moderator:Rahma Hersi, Partner, Gateway

Panelists:Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Jean-Pierre Labuschagne

Mohamed Ali Maawy, Director of Business Development, iFinancial Management

Nicole Gichuhi, Senior Associate, Anjarwalla & Khanna

Victor Nikiiri, Capital Markets Development Specialist, FSD Africa

12:00

Keynote Address: Pensions in Kenya - Opportunities for Shariah Compliant Options

Nzomo Mutuku, CEO, Retirement Benefits Authority

12:20

Recent Developments in International Islamic Financing and Sukuk Markets

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

12:35

Nurturing Digitization and Financial Technology in Kenya and Promoting Financial Inclusion in East Africa

Through an expert panel we discuss the role of technology in the Kenyan financial services industry, and assess the latest developments in platforms, products and delivery channels across a wide spectrum of financial services. What do blockchain and smart contracts offer Islamic financial institutions, intermediaries and end-users, and what solutions are on offer to serve retail and SME sectors in particular? How can technology drive and promote financial inclusion in Kenya?

Moderator:Tego Wolasa, Retail and Product Development Manager, KCB Sahl Bank

Panelists:Ali Hussein, Principal, AHK & Associates

David Cracknell, Director, First Principles Consulting

Declan Magero, Founding Partner, Afrinet Capital

Joel Macharia, Founder and CEO, Abacus Kenya

13:15

End of Forum and Networking Luncheon

Ahsan Ali

Head of Islamic Origination, Standard Chartered Bank

Ali Hussein

Principal, AHK & Associates

Claire Matheson Kirton

Partner, White & Case

David Cracknell

Director, First Principles Consulting

Declan Magero

Founding Partner, Afrinet Capital

Jean-Pierre Labuschagne

Joel Macharia

Founder and CEO, Abacus Kenya

Justus Agoti

Senior Researcher, Capital Markets Authority

Mohamed Ali Maawy

Director of Business Development, iFinancial Management

Nicole Gichuhi

Senior Associate, Anjarwalla & Khanna

Nzomo Mutuku

CEO, Retirement Benefits Authority

Rahma Hersi

Partner, Gateway

Tego Wolasa

Retail and Product Development Manager – KCB Sahl Bank

Victor Nikiiri

Capital Markets Development Specialist, FSD Africa

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Aziza Ebrahim

Advisor to CEO, Oasis Crescent

Baha Osman

Managing Director, Osman Consulting

Hajara Adeola

Managing Director/CEO, Lotus Capital

Mona Doshi

Partner, Anjarwalla & Khanna

Mohamed Ali Maawy

Director of Business Development, iFinancial Management

Mubarak Elegbede

Manager, Trade Finance Department, International Islamic Trade Finance Corporation (ITFC)

Saad Rahman

Group Managing Partner, Amani Partners

LEAD PARTNERS

MULTILATERAL STRATEGIC PARTNERS

PARTNERS

IN ASSOCIATION WITH

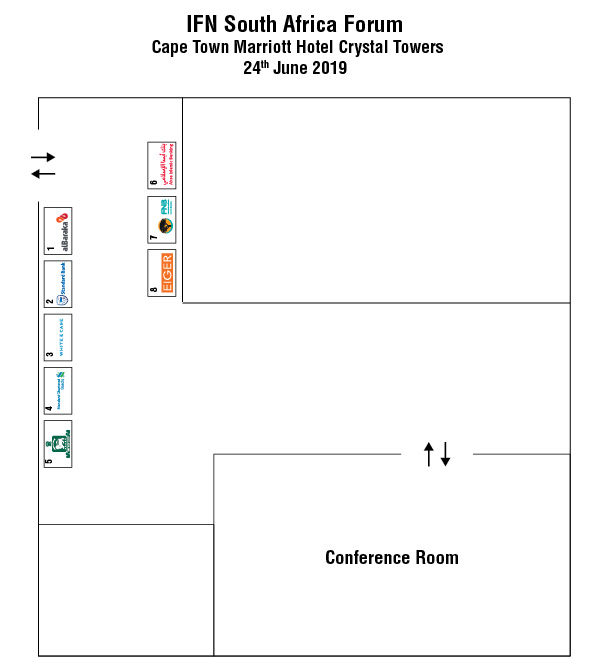

IFN SOUTH AFRICA FORUM 2019

Among the African countries that are increasingly permeating the global Islamic finance industry, South Africa is a prominent game-changer.

Its conventional legislation has been tailored to better facilitate Shariah compliant financial transactions, and since 2010, various legislation has seen daylight to better accommodate the industry. On the Sukuk front, the country led its regional peers by issuing its debut Sukuk worth US$500 million in 2014, with another expected to follow suit in this fiscal year.

Date 24th June 2019

Venue Cape Town Marriott Hotel Crystal Towers

09:00

Welcome Remarks

09:10

Keynote Address

Cas Coovadia, Managing Director, The Banking Association of South Africa

09:20

Opportunities for Islamic Finance, Banking and Investment in Southern Africa

We discuss key ideas, issues and themes influencing Islamic finance, banking and investment in Southern Africa and beyond. What will offer opportunity and what will disrupt and what role will Islamic finance play in the development of financial inclusion and the achievement of the UN Sustainable Development Goals in Southern Africa? What is needed to grow regional Islamic capital markets, investment management, banking and Takaful, and what role is technology set to play?

Moderator:Claire Matheson Kirton, Partner, White & Case

Panelists:Amman Muhammad, CEO, FNB Islamic Banking

Mohammad Mohsin Ahmed, Islamic Branch Manager, HBZ Bank

Mohammed Ameen Hassen, Head of Shariah Banking, Standard Bank

Riaz Lachman, Head, Absa Islamic Banking

Shabir Chohan, CEO, Al Baraka Bank – South Africa

10:20

Why Islamic Banking and Why it makes Sense for South Africa

Shaykh Taha Karaan, Member, Shariah Supervisory Board, Absa Islamic Banking

10:35

Coffee & Networking

11:05

Innovation in Islamic Banking and Finance: Benefiting the South African Consumer

We showcase recent achievements in development and innovation across a wide range of Islamic banking and finance activities and assess how end consumers have benefited from the availability of Islamic finance product offerings.

Moderator:Riaz Lachman, Head, Absa Islamic Banking

Panelists:Asad Kaka, Regional Head, Absa Islamic Banking

Mohammed Ameen Hassen, Head of Shariah Banking, Standard Bank

Shaheen Suliman, Head of Islamic Retail Banking, First National Bank

12:00

Corporate Financing, Capital-Raising and Asset Management in South Africa: Opportunities for Islamic and Responsible Finance

Through a panel of leading advisors and investment managers, we discuss the prospects for domestic and regional capital markets. What structures and asset classes will find favor with issuers and investors and where does Islamic finance fit in? What challenges still exist within regional taxation and regulatory frameworks for Islamic capital market and asset management products and how can these be addressed? Five years after the maiden South African US$500 million sovereign issuance, what do Sukuk offer Southern African sovereign, multilateral and supranational issuers? Finally, what are the opportunities for Islamic and ethical finance to fund and cooperate with sustainable and responsible projects in key sectors such as energy, education, healthcare and agriculture?

Moderator:Amman Muhammad, CEO, FNB Islamic Banking

Panelists:Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Abdullah Ameed, Financial Director, Al Baraka Bank – South Africa

Aseef Hassim, CFO, FNB Islamic Banking

Ebrahim Tootla, Head of Shariah ALM/TCM, Standard Bank

12:50

Presentation: Market Conduct and Prudential Regulation — the South African Islamic Financial Services Industry and the Implementation of Twin Peaks

Kershia Singh, Head of Market, Customer and Inclusion Research, Financial Sector Conduct Authority

13:05

Recent Developments in International Islamic Financing and Sukuk Markets

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

13:20

Regulatory, Taxation Issues and Shariah Governance Frameworks for Islamic Banks in South Africa: Challenges and Solutions

Moderator:

Shabir Chohan, CEO, Al Baraka Bank – South Africa

Panelists:Ahmed Suliman, Shariah Advisor, FNB Islamic Banking

Mufti Shafique Jakhura, Member, Shariah Supervisory Board member, Al Baraka Bank – South Africa

Yasmeen Suliman, Executive, Tax, Bowmans

Yusuf Suliman, Head, Shariah Advisory, Standard Bank

14:00

End of Forum & Luncheon

Abdullah Ameed

Financial Director, Al Baraka Bank – South Africa

Ahmed Suliman

Shariah Advisor, FNB Islamic Banking

Ahsan Ali

Head of Islamic Origination, Standard Chartered Bank

Amman Muhammad

CEO, FNB Islamic Banking

Asad Kaka

Regional Head, Absa Islamic Banking

Aseef Hassim

CFO, FNB Islamic Banking

Cas Coovadia

Managing Director, The Banking Association of South Africa

Claire Matheson Kirton

Partner, White & Case

Ebrahim Tootla

Head of Shariah ALM/TCM, Standard Bank

Kershia Singh

Head of Market, Customer and Inclusion Research, Financial Sector Conduct Authority

Mohammed Ameen Hassen

Head of Shariah Banking, Standard Bank

Mufti Shafique Jakhura

Member, Shariah Supervisory Board member, Al Baraka Bank – South Africa

Riaz Lachman

Managing Director, Absa Islamic Banking

Shabir Chohan

CEO, Al Baraka Bank – South Africa

Mohammad Mohsin Ahmed

Islamic Branch Manager, HBZ Bank

Shaheen Suliman

Head of Islamic Retail Banking, First National Bank

Shaykh Taha Karaan

Member, Shariah Supervisory Board, Absa Islamic Banking

Yasmeen Suliman

Executive, Tax, Bowmans

Yusuf Suliman

Head, Shariah Advisory, Standard Bank

Ahsan Ali, Head of Islamic Origination, Standard Chartered Bank

Kershia Singh, Head of Market, Customer and Inclusion Research, Financial Sector Conduct Authority

Amman Muhammad

CEO, FNB Islamic Banking

Aziza Ebrahim

Advisor to CEO, Oasis Crescent

Baha Osman

Managing Director, Osman Consulting

Hajara Adeola

Managing Director/CEO, Lotus Capital

Mohammed Ameen Hassen

Head, Shariah Banking, Standard Bank

Mubarak Elegbede

Manager, Trade Finance Department, International Islamic Trade Finance Corporation (ITFC)

Riaz lachman

Managing Director, Absa Islamic Banking

Saad Rahman

Group Managing Partner, Amani Partners

Shabir Chohan

CEO, Al Baraka Bank

LEAD PARTNERS

MULTILATERAL STRATEGIC PARTNERS

IN ASSOCIATION WITH

PARTNERS

MEDIA PARTNERS

Last Visit to Africa

Kenya, one of the fastest-growing economies in Africa, is now a leading contender in the bid to become Africa’s Islamic finance hub.

Efforts by Kenya’s financial regulators have paid off and paved the way forward for the country’s Islamic finance industry. With its much anticipated sovereign issuance, recently proposed CMA legislation promoting the use of Islamic financial products and the government’s commitment to position Kenya as a center of excellence for Shariah finance, the Islamic Corporation for the Development of the Private Sector and REDmoney Events are pleased to announce that our inaugural IFN Kenya Forum will take place in Nairobi on 27th November.

With all eyes on Kenya’s progress in Islamic finance, the IFN Kenya Forum will host some of the most influential Islamic finance dealmakers from Europe, the Middle East and key African economies.

Dr Yakubu 2016

Thank you for inviting me to the event co-sponsored by the government of Cote d’Ivoire, the Islamic Corporation for the Development of the Private Sector (ICD) and the REDmoney Group. I appreciate the opportunity given to participate as one of the panelists at the Africa Islamic Finance Forum. I indeed found it to be useful, thought provoking and an opportunity to advocate the sustained growth of Islamic finance in Africa. The networking opportunities and exposures were valuable. Extend my sincere appreciation to the Minister of Planning and Development for all the Hospitality provided during the two-day event. I will honor future invitations in support of future Africa Islamic Finance Forum events.

Hajara Adeola-nigeria19

Congratulations on a very successful event.

Bashir Sharif Isyaku-nigeria19

This is the best Islamic Finance Forum I have ever attended.

Jude Chiemeka-nigeria19

Very much appreciated and a big congratulations to you and your team. The event was very successful. We look forward to many more collaborative efforts.

Toyin Kekere-Ekun-nigeria19

IFN Nigeria Forum was the perfect platform to boost discussions around the growth and direction of Islamic finance in Nigeria. The diversity of participants, involvement of regulators and pertinent topics deliberated all contributed to the success of the event. We are pleased to have partnered on such an impactful forum.

Amman Muhammad-southafrica19

A big thank you for all the effort you put into this conference. Alhamdulilah we are getting very positive feedback. This initial conference has provided great perspectives

Phil Attwood-southafrica19

We attended the Kenya and South African legs of the IFN African Roadshow and found both to be well attended and organized; this was especially the case in Cape Town where the quality of speakers and discussion was very high.

Moulana Yusuf Jeena-southafrica19

Thank you for putting together a successful IFN South Africa 2019!

Nazeer Cassim-southafrica19

Many thanks to Andrew Tebbutt and the REDmoney team on delivering an exceptional event in South Africa. The agenda covered critical issues and challenges facing Islamic banking in South Africa, with possible solutions. The various speakers and panel participants were well versed within their respective fields. Most importantly, the networking among all invited guests was invaluable. We look forward to the follow-up event in 2020.

For any inquiries contact us

Our team will be glad to answer any questions you may have about this event.

-1.jpg)