9.15 – 9.20

Welcome Address

Dr Recep Senturk, Dean, College of Islamic Studies, Hamad Bin Khalifa University

9.20 – 9.30

Keynote Address

Yousuf Mohamed Al-Jaida, Board Member and CEO, Qatar Financial Centre

9.30 – 11.30

Dialogue One: Diversifying Qatar’s Economy — The Role of Islamic Financial Markets

- What is a realistic assessment of today’s Shariah compliant capital and financial markets in Qatar?

- How does the domestic regulatory environment allow for the growth of the Qatari Islamic capital markets?

- Could amendments be made to capital market regulations, or could more be done by regulators? If so, what form would this evolution take?

- What can Islamic finance and investment offer in the drive toward the diversification of the Qatari economy?

- What steps should Qatar take to drive post-FIFA direct investment, and what role can Shariah compliant structures play?

- Are Qatar’s Shariah compliant financial institutions in a favorable position in a post-FIFA environment in terms of liquidity and ongoing projects?

- Developing the Islamic capital market in Qatar: increasing market depth and liquidity, driving product innovation and widening the investor base

- How has the Qatar Central Bank 2022 Treasury Sukuk issuance helped domestic Islamic banks manage their liquidity as well as ease issuer entry into the Sukuk market?

- Funding routes for Qatari corporates: Islamic capital markets versus bank funding

- How can Shariah compliant structures be further applied to the funding of projects and infrastructure in Qatar?

- How will privatization and the private sector continue to play a role in the provision of infrastructure and public services in Qatar?

- In the shift away from hydrocarbons, what sectors and activities are ripe for growth and development in Qatar, and how can Islamic sustainable capital market products facilitate this rotation?

- How can Shariah compliant transition, sustainable and sustainability-linked finance and investment products be further incorporated into the Qatari market?

Dr Dalal Aassouli, Assistant Professor of Islamic and Sustainable Finance, Hamad Bin Khalifa University

Panelists:Akber Khan, Senior Director – Asset Management, Al Rayan Investment

Ayman Doukali, Head of Islamic and Structured Finance, Qatar Financial Centre

George Barakat, Group Treasury Director, Power International Holding

Mohsin Shaik Sehu Mohamed, Head of Investment Banking and Capital Markets, Maisarah Islamic Banking Services

Munaf Usmani, Senior Vice-President, Treasury and Markets, QInvest

Sabir Ahmed, Executive Director, Islamic Origination, Standard Chartered Bank

Tahir Hayat Pirzada, GM, Group Treasurer and Financial Institutions, Masraf Al Rayan

11.30 – 11.40

IFN Awards

11.40 – 12:10

Coffee

12:10 – 14.10

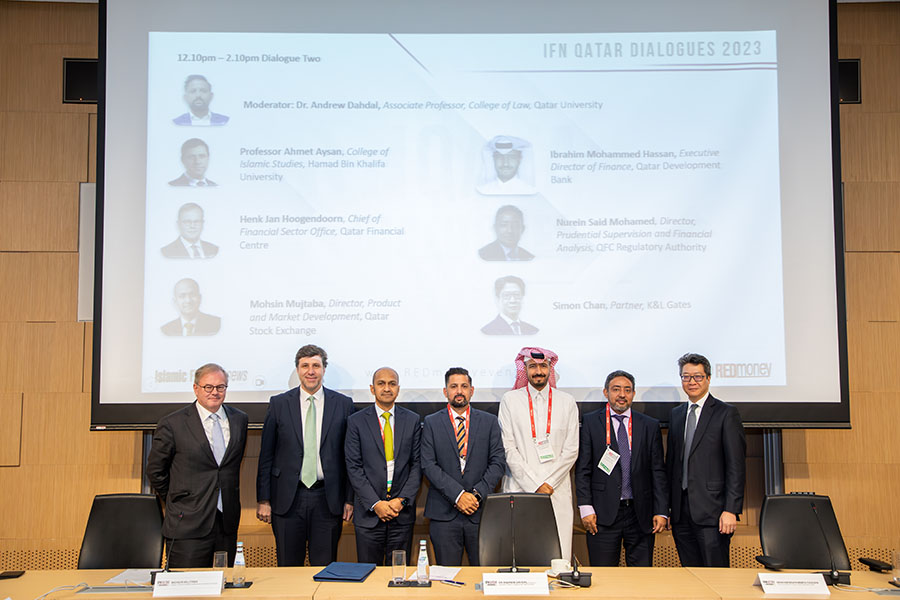

Dialogue Two: Achieving National Objectives through Islamic Banking — Innovation, Transformation and Digitalization

- How have domestic bank mergers altered the Islamic banking sector in Qatar, and what further changes are on the horizon?

- How does the domestic prudential banking regulatory environment allow for the growth of the Qatari Islamic banking sector?

- Could amendments be made to banking regulations, or could more be done by regulators? If so, what form would this evolution take?

- How are Qatar’s Islamic banks positioned post-FIFA in terms of liquidity and asset growth?

- Do Tier 1 and Tier-2 Sukuk offer Qatari Islamic banks the most flexible, efficient and user-friendly way of satisfying regulatory capital requirements?

- What other funding options are open to Qatari Islamic banks, and what liquidity management tools are available?

- The digitalization of Islamic financial services in Qatar: what is working, what is viable and what is not?

- What do the answers to these questions mean for the evolution and transformation of Islamic financial services in Qatar?

- With Qatar emerging as a leading Islamic fintech center, how significant is the work of Qatar FinTech Hub’s acceleration and incubation programs?

- Does the digitalization of Islamic financial services allow us to better address issues such as product authenticity and the minimization of uncertainty, and are we leveraging on this sufficiently?

- Is it feasible to require Islamic banks in Qatar to incorporate ESG frameworks as part of a wider Islamic banking philosophy?

- How can Shariah compliant banking be applied to social impact initiatives in Qatar, enriching lives through the advancement of education, housing, health, culture and well-being?

Dr Andrew Dahdal, Associate Professor, College of Law, Qatar University

Panelists:Dr Ahmet Aysan, Associate Dean for Research, College of Islamic Studies, Hamad Bin Khalifa University

Henk Jan Hoogendoorn, Chief of Financial Sector Office, Qatar Financial Centre

Ibrahim Mohammed Hassan, Executive Director of Finance, Qatar Development Bank

Mohsin Mujtaba, Director, Product and Market Development, Qatar Stock Exchange

Nurein Said Mohamed, Director, Prudential Supervision and Financial Analysis, QFC Regulatory Authority

Simon Chan, Partner, K&L Gates

14.10

Luncheon