Dr Abideen Adeyemi Adewale

Head of Research, Publications, and Statistics, Islamic Financial Services Board (IFSB)Dr Abideen Adeyemi Adewale joined the IFSB in April 2018 as a lead specialist. He is presently the head of research, publications and statistics in the Technical and Research Department at the IFSB, where he also oversees the research activities as well as the coordination and publication of research papers and the flagship IFSB Islamic Financial Services Industry Stability Report. Dr Abideen also complements activities relating to the facilitation of workshops on the implementation of IFSB standards, and other technical matters at the IFSB.

Prior to joining the IFSB, Dr Abideen worked at the International Islamic University Malaysia (IIUM) as an associate professor of finance, the head of the PhD in Islamic Banking and Finance program and editor of the Journal of Islamic Finance. He had previously worked in Nigeria with a brief stint in a stockbroking firm, and later as a lecturer at the Department of Accounting and Finance at the University of Ilorin in Nigeria. Dr Abideen obtained his PhD in business administration from IIUM where he also did a postdoctoral fellowship. He obtained his Master of Science degree in finance and Bachelor of Science degree in finance from the University of Lagos in Nigeria and the University of Ilorin in Nigeria respectively.

Ahmad Shahriman Mohd Shariff

CEO, CIMB Islamic BankAhmad Shahriman Mohd Shariff was appointed CEO of CIMB Islamic Bank on the 1st October 2019. In this role, he heads the Group Islamic Banking business of CIMB Group including Islamic wholesale banking, Islamic consumer banking, Islamic commercial banking and Islamic asset management and investment across key markets such as Malaysia, Singapore and Indonesia. Ahmad is also a board member of CIMB Islamic Bank; the secretary of the Association of Islamic Banking and Financial Institutions Malaysia; a member of the Standing Committee on Islamic Financial Reporting, Malaysian Accounting Standards Board; and an honorary senior fellow of the Centre for Islamic Economics, International Islamic University Malaysia.

Ahmad has over two decades of experience in the corporate sector, of which 16 years were in Islamic banking and finance-related leadership roles at HSBC Amanah Malaysia as the director of wholesale banking, and Citigroup where he served as the head of Islamic banking at Citibank, among others.

Dr Ayaz Ismail

Director – Wholesale Banking, CIMB Islamic BankDr Ayaz Ismail is the director of wholesale banking at CIMB Islamic in Malaysia, where he covers Islamic investment banking transactions. He has been involved in various ground-breaking and award-winning ringgit and non-ringgit Sukuk offerings. Prior to joining CIMB Islamic, he was with Malaysian multinational conglomerate Sime Darby, carrying out various roles in the CEO’s Office, as well as legal, strategy and communications functions of the group.

Dr Ayaz completed his PhD in Islamic finance at INCEIF University, Malaysia. He graduated with an MBA in financial studies from the University of Nottingham in the UK as a Chevening scholar, and also holds a Bbachelor of Laws (Hons) degree from the same university. He is a Chartered Professional in Islamic Finance charterholder and a grand councilor of the Chartered Institute of Islamic Finance Professionals.

Professor Azmi Omar

President and CEO, International Centre for Education in Islamic Finance (INCEIF)Professor Dr Mohd Azmi Omar is the president and CEO of the International Centre for Education in Islamic Finance (INCEIF) – The Global University of Islamic Finance. Prior to his current position, he served as the director-general at Islamic Research and Training Institute (IRTI), IsDB Group, Jeddah in the Kingdom of Saudi Arabia. At IRTI, Dr Azmi pioneered and introduced an innovative policy research which culminated in flagship reports such as the IRTI Islamic Social Finance Report and the IsDB-World Bank Global Report on Islamic Finance. Dr Azmi has also provided advice and technical assistance in Islamic finance to several IsDB member countries.

Dr Azmi was a member of the board of trustees of Responsible Finance Institute Foundation and External Advisory Group for the IMF Interdepartmental Working Committee on Islamic Finance. He was awarded ‘The Most Outstanding Individual Contribution to Islamic Finance’ accolade at the KLIFF Islamic Finance Awards 2015.

Dr Azmi has held numerous positions at International Islamic University Malaysia, including deputy rector (academic and research), dean of Institute of Islamic Banking and Finance and dean of Faculty of Economics and Management Sciences. He serves as a member of the Shariah committees of Bank Rakyat Malaysia and Etiqa Takaful Malaysia, and as an Islamic finance expert to Autoriti Monetari Brunei Darussalam. Recently, he led a team that developed the Indonesia Shari’ah (Islamic) Economy Masterplan 2019–2024 for the government of Indonesia.

Dr Azmi holds a Bachelor of Science (Finance) degree and an MBA from Northern Illinois University in the US and a PhD in finance from Bangor University, Wales in the UK. He is also a holder of the Chartered Professional in Islamic Finance qualification.

Dr Aznan Hasan

Professor in Shariah and Islamic Banking, Institute of Islamic Banking and Finance, International Islamic University MalaysiaDr Aznan Hasan is a professor in Shariah and Islamic banking at the Institute of Islamic Banking and Finance, IIUM. He was the founding president of the Association of Shariah Advisors in Islamic Finance. He is also the deputy chairman of the Shariah Advisory Council of the Securities Commission Malaysia (SC) and the deputy chairman of the Shariah Advisory Committee of the Employees Provident Fund.

Currently, Dr Aznan is the chairman of the Shariah committee of Maybank Islamic, Bank Pembangunan Malaysia, Etiqa General Takaful and Etiqa Family Takaful. He also serves as the chairman of the Shariah advisory board of FNB Bank (South Africa) and as a member of the Shariah Advisory Council of HSBC Amanah (Dubai), among others.

Dr Aznan is a registered Shariah advisor for the Islamic unit trust schemes and Islamic securities (Sukuk) at the SC and a member of the Shariah supervisory board of the Malaysian Waqaf Foundation.

Dr Aznan received his first degree in Shariah from the University of al-Azhar (1994). He then successfully completed his Master’s degree in Shariah from Cairo University with distinction (Mumtaz) (1998). He then obtained his PhD from the University of Wales, Lampeter, in the UK (2003).

Bikesh Lakhmichand

CEO, 1337 VenturesBikesh Lakhmichand is no stranger to the world of digital disruption in Southeast Asia. He is the founding partner of 1337 Ventures, Malaysia’s first accelerator program that has invested in over 60 innovative digital start-ups across diverse areas spanning gaming, social networking, education, big data, proximity marketing, wearable technology, fintech and recently, social enterprises. 1337 Ventures is the mastermind behind Alpha Startups, an intensive five-day design sprint-based pre-accelerator boot camp that has helped numerous start-ups the likes of ParkEasy and Gigfairy that went from idea to exit in just 12 months.

Beyond helping to discover, validate and scale high-potential start-ups from ideas to businesses of the future, Bikesh utilizes his experience in the start-up scene to help corporates such as Khazanah, Maybank and CIMB transform and compete in the digital age. Bikesh helps corporates via consultation to create new business units or services, design thinking to equip them with relevant skill sets and knowledge and organize accelerator programs to identify start-ups to solve their problem statements.

Dean Gillespie

CEO, Islamic Bank of AustraliaDean Gillespie is CEO of Islamic Bank Australia and has extensive banking and start-up experience across both Australia and Asia. He has led the creation of Australia’s first Islamic bank since 2018. He was previously in charge of home loan sales at the Commonwealth Bank of Australia and the head of mortgages at Bankwest where he doubled the business’s size within three years. He also ran the retail bank at Vietnam International Bank in Hanoi across 160 branches nationwide, where he built the bank’s first mobile banking app.

Dean has a history of founding start-ups including SparkleVote, an innovative online election company. Outside of work, Dean is the chair of the UK’s aeroplane ambulance service, flies aircraft and studies astrophysics part-time. He holds a Master of Finance degree and a Bachelor of Economics degree. Dean joined Islamic Bank Australia largely as a volunteer in 2018 before transitioning to full-time CEO in 2020. He is passionate about the need to support Muslim Australians in building the first Islamic bank. His knowledge of Australian retail banking and his commitment to ethical banking are key drivers in delivering the Islamic Bank Australia Vision to reality.

Elias Moubarak

Partner, Trowers & HamlinsElias trained and worked with Mayer Brown in London before moving to Dubai, and joined Trowers & Hamlins in 2014 from Clifford Chance. Elias has a broad range of experience both in the conventional and Islamic finance spheres. He has significant experience in representing the full spectrum of stakeholders on a range of banking and finance transactions including project financings and real estate financings as well as capital market issuances.

Faridah Bakar Ali

CFO, Khazanah NasionalFaridah Bakar Ali is CFO of Khazanah Nasional. She joined Khazanah after building a career in accountancy and finance with PwC Malaysia and BP Malaysia.

At Khazanah, Faridah delivered several notable Islamic finance transactions including the world’s first exchangeable Sukuk and the largest Singapore dollar Sukuk. She was also involved in the financing of mixed development projects by M+S, where Khazanah was a joint venture party.

Faridah oversaw the inaugural retail offering of Sukuk Ihsan, Khazanah’s sustainable and responsible investment Sukuk, to fund Yayasan AMIR’s Trust Schools Programme, a public–private partnership with the Ministry of Education to improve accessibility of quality education in Malaysian public schools.

Faridah graduated from Lancaster University in accounting and finance. She is a member of the Malaysian Institute of Accountants and a fellow of the Institute of Chartered Accountants in England and Wales. She currently sits in various boards and audit committees.

Ikram Khaliq

Head of Digital Bank, Al-Rajhi Bank MalaysiaA thought leader in data and technology, with the ability to design and implement a future vision

and strategy around people, process and technology, Ikram Khaliq has a passion for always making a difference, and understanding the ‘why’, while seeing the bigger picture and including people on the journey.

In 2022, Ikram joined Al Rajhi Bank Malaysia as the head of digital bank to lead the digital bank

effort. No stranger to the fintech world, Ikram has over 16 years of international experience

mentoring and building tech firms in the fintech and insuretech industries. Specializing in fintech

consultancy, he successfully implemented innovative solutions across banking, wealth and asset

management, insurance and financial services. Ikram holds a degree in financial mathematics from Brunel University in the UK with Agile and Prince 2 certifications.

Joann Enriquez

CEO, Investment Account Platform“Build a mechanism that churns good over and over again, circulates good and thrive” —

this is the mantra of Joann Enriquez, CEO of Raeed Holdings and its subsidiary, IAP Integrated, the owner of the Investment Account Platform, the first Islamic multibank investment platform in the world (www.iaplatform.com). Her team is working toward unlocking the flow of capital into SMEs in Malaysia with the use of crowdfunding into Investment Account Platform, a Malaysian central bank product. This landmark initiative is a testimony of its leadership in the Islamic financial landscape by incubating new innovative products that promote financial responsibility and risk-sharing.

Joann has over 20 years of experience in financial technology from various S&P 500 companies in the Silicon Valley in California where she led cross-functional teams in the US and in the global community.

Joann obtained a double Bachelor’s degree in business administration and international studies from De La Salle University, Manila; and an MBA and DBA (candidate) from the University of Phoenix, Arizona. She also obtained a second Master’s degree in Islamic finance practice at the International Center for Education in Islamic Finance, Malaysia and a Certificate of Leadership from the Wharton School of Business, University of Pennsylvania.

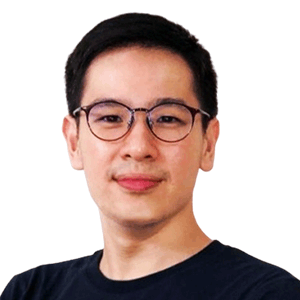

Jun Jie Yoon

Founder and CEO, Capsphere SME FinancingYoon Jun Jie is CEO and founder of Capsphere, Malaysia’s first asset-based peer-to-peer financing and investment platform registered with Securities Commission Malaysia. He started Capsphere to support local SMEs and to enable communities to take part in their growth. Previously, he was the vice-president in the Southeast Asia Global Corporate Banking team at Bank of America. He has gained experience in facilitating debt financing and advising on cash management and treasury solutions for global corporations and financial institutions.

Yoon has completed the Professional Credit Certification from Asian Institute of Chartered Bankers. His education background includes a Master of Philosophy degree in economics from the University of Cambridge and Bachelor of Science degree in statistics, economics and finance from University College London.

Matthew Martin

Founder and CEO of Blossom Finance, Blossom FinanceMatthew Martin is the founder and CEO of Blossom Finance, a blockchain-based Sukuk platform for social impact investing. Matthew has been an early pioneer in the application of fintech for Islamic finance with a background including both engineering and product management experience in the digital wallet, payment card, money remittance, mobile payments and mobile banking sectors at venture capital funded tech start-ups Xoom, Boku and Monitise. Matthew has advised policymakers at central banks and financial services regulators on blockchain technology and has spoken as an educator to international audiences in Bahrain, Indonesia, Malaysia, Qatar, Russia, Singapore, the UAE and the US.

Prior to Blossom, Matthew started his first blockchain-related venture in 2013 — back when Bitcoin was less than US$100 — which allowed the instant purchase of Bitcoin in 27 countries using just a mobile phone. At Monitise, Matthew led the team that pioneered one of the world’s first in-mobile NFC [near-field communication] payment product for banks, and fully owned the entire delivery of that solution from technology through to commercial agreements.

Prior to that, Matthew was the product architect and team lead for Monitise’s flagship iOS and Android white-label mobile banking platform, which grew to be the market-leading solution for the US consumer banking market. Under Matthew’s leadership, the team delivered a new platform and architecture that dramatically reduced the overall delivery time of client solutions and reduced the ongoing cost of ownership while maintaining a broad range of features and customization capabilities. At Boku, Matthew was product owner of Boku Accounts: in-person payments using the world’s first Visa PayWave™ NFC sticker. Previously, as the engineering manager of the accounts team, Matthew led a team of 10 engineers to build a white-label payments and merchant loyalty product that resulted in a strategic investment by Visa. Before leading the accounts team, Matthew delivered various proof-of-concepts instrumental in landing key clients such as Disney and Facebook. At Xoom, Matthew evangelized user experience and user-centered design, and championed the first push into mobile; he helped design and run Xoom’s first-ever user study.

Prior to financial tech, Matthew worked in consumer electronics as a software engineer at Logitech as part of their Streaming Media Business Unit and at Benchmark Media Systems as a software engineer. Matthew has studied eight languages and speaks Indonesian, Farsi and French at an intermediate level in addition to his native English. Matthew embraced Islam in 2010 and currently lives in Jakarta, Indonesia.

Michael Orzano

Global Head of Equity Indices, S&P Dow Jones IndicesMichael Orzano (Mike) is the senior director of global equity indices at S&P Dow Jones Indices (S&P DJI). He is responsible for the product management of S&P DJI’s global equity, real estate and Islamic indices including the S&P/ASX and S&P/TSX series. In this role, Mike leads S&P DJI’s efforts developing new benchmarks for international equity markets and promotes their use among global clients. He also regularly publishes research, analytical reports and market commentary on a variety of international investment topics.

Prior to joining S&P DJI, Mike was a research analyst at Endurance Capital, a New York-based private equity firm, where he was responsible for evaluating investments in banks and other financial institutions. He has also worked as an investment performance analyst at Cambridge Associates.

Mike holds a Bachelor’s degree in economics from Georgetown University. He is also a CFA charterholder and a member of the New York CFA Society.

Dr Mohamad Zabidi Ahmad

Regional Chief Representative, DDCAP GroupDr Mohamad Zabidi Ahmad has worked in the banking industry for 38 years. He has amassed 19 years of experience in group treasury products and functions (conventional and Islamic) including corporate (deposits, investments, client solutions), interbank, fixed income and derivatives, product development, structuring and marketing. He previously served as the senior managing director and regional head of Islamic treasury, treasury and markets in group wholesale banking for CIMB Group. During that time, he was responsible for the development of CIMB Group’s regional Islamic treasury franchises, managing over RM100 billion (US$23.88 billion) of Islamic assets for CIMB Group Islamic Banking. His country-focused treasury remits included Singapore, Indonesia, Brunei and Thailand and for five years, he was based in London as a chief dealer. His innovations included the introduction of CIMB’s Islamic repo contract.

Dr Mohamad Zabidi has held various additional executive management positions within the CIMB Group, including the chairman of the Investment Account Oversight Committee and a member of the Group Islamic Management Committee, the Treasury and Market Committee and the Group Islamic Wholesale Banking Committee. He has been widely recognized for his leadership, with CIMB announced as ‘Best Islamic Bank for Treasury Management’ at the IFN Awards in 2019. He previously participated in the Bursa Malaysia/Bank Negara Malaysia Working Group resulting in the formation of the Bursa Suq Al-Sila’ Commodity House and the Working Group resulting in the establishment of the International Islamic Liquidity Management Corporation.

Dr Mohamad Zabidi served as a proactive chairman of AIBIM Treasury & Markets, leading the CMTC Sukuk Index Task Force in the successful launch of the Sovereign & Corporate Bloomberg-AIBIM-Bursa Sukuk Index in September 2012. In 2018, under his leadership, AIBIM also published the practice notes for Qard Hasan and commodity Murabahah for adoption by AIBIM members. He has presented papers on Islamic treasury products to various central banks, including the Hong Kong Monetary Authority, Bank Indonesia and Bank Negara Malaysia.

Among his academic and professional achievements, Dr Mohamad Zabidi holds a doctorate in business administration from Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia and has a Bachelor in Accountancy degree with honors from Universiti Teknologi MARA.

A qualified chartered accountant, Dr Mohamad Zabidi is a practicing member of the Malaysian Institute of Accountants, a certified senior financial market practitioner by ACI-Financial Market of Malaysia and the Asian Institute of Chartered Bankers and holds an Associate Qualification in Islamic Finance from the Islamic Banking & Finance Institute Malaysia and that of senior associate from the Chartered Institute of Islamic Finance.

Dr Mohamed Eskandar Shah

Associate Dean Academic, Associate Professor, Islamic Finance, College of Islamic Studies, HBKU, Qatar FoundationAssoc Prof Dr Mohamed Eskandar Shah Mohd Rasid is currently an associate professor at the College of Islamic Studies, HBKU Qatar Foundation. He holds a PhD in finance from the University of Nottingham in the UK. He also has a Master in International Economics and Finance degree from the University of Queensland, Australia and a Bachelor in Business Administration (Finance) degree from International Islamic University Malaysia (IIUM).

Before joining HBKU, Dr Eskandar was an associate professor and associate dean of the School of Graduate and Professional Studies at the International Centre for Education in Islamic Finance or INCEIF, a postgraduate university specializing in Islamic finance, established by Bank Negara Malaysia.

Dr Eskandar’s primary teaching and research interests are in corporate finance, portfolio management and the Islamic capital market. He has published articles in several top-tier journals and participated in conferences as an invited speaker, panelist and paper presenter.

Dr Eskandar was a financial sector specialist consultant for the World Bank and advisor for the Brunei Institute of Leadership and Islamic Finance in Brunei. He was involved in several consultancy projects with government agencies and financial institutions such as the Ministry of Energy, Malaysia; Afghanistan Ministry of Finance; CIMB Islamic Bank; Responsible Finance Institute; and ZICO Shariah Advisory.

Mohamed Hamza Ghaouri

Consultant, Fineopolis Al Maali ConsultingMohamed Hamza Ghaouri is currently a PhD candidate at IUM Institute of Islamic Banking and Finance, Malaysia. Having moderate experience in Malaysian and Moroccan research centers and consultancy agencies, his research area is Islamic social finance. As a certified blockchain associate, he is passionate about the deployment of financial technologies to solve social issues. He has headed the French training program at IBF Net where he prepared several modules in different areas of Islamic finance. He had delivered some seminars and presented academic papers in many international conferences. He is currently a consultant for Fineopolis working on delivering projects in different areas of Islamic finance.

Besides consultancy, and with his moderate experience in Malaysia, Mohamed Hamza is representing the company and conducting business development activities in Southeast Asia. Before joining Fineopolis, he worked closely with a few Islamic fintech companies specializing in Islamic social finance. His job was to assist the management team to conduct research and advisory for the company as well as to represent it at various conferences and seminars. In 2019, he was part of a team that won the second prize in the Islamic Fintech Pitch Competition organized in parallel with the Islamic Fintech Dialogue conference in Kuala Lumpur.

Mohammed Paracha

Head of Middle East, Norton Rose FulbrightMohammed Paracha is a banking and finance lawyer based in Dubai. He is the head of the Middle East, as well as the head of Norton Rose Fulbright’s Islamic finance practice for the Middle East and Africa.

Mohammed has been active in the Middle East for nearly 20 years, having worked in Norton Rose Fulbright’s London and Bahrain offices before moving to Dubai in 2011. He became the head of Norton Rose Fulbright’s Middle East practice in January 2021.

Mohammed’s practice focuses on all types of Islamic finance covering a wide range of asset types, investment classes and industrial sectors. With a background in asset and project finance, Mohammed advises on Shariah compliant asset finance, trade finance, real estate finance and project financings. He also advises on the structuring of Islamically acceptable investment funds and has advised on the establishment of new Islamic financial institutions in various countries. Mohammed has strong relationships with many of the internationally renowned Shariah scholars and is a regular speaker at conferences and seminars on Islamic finance topics.

Mohammed is recommended as a leader in his field by Chambers and Partners, The Legal 500, Acritas and IFLR.

Mohd Suhaimi Abdul Hamid

CEO, Standard Chartered SaadiqMohd Suhaimi Abdul Hamid was appointed as CEO of Standard Chartered Saadiq in March 2019. Suhaimi has experience in Islamic banking across retail, commercial and corporate banking and has garnered domestic and regional exposure throughout his career in local and multinational financial institutions. He joined Standard Chartered Bank in 2009 and had multiple functions across retail and commercial banking.

Suhaimi has traveled extensively throughout his 20-odd years in the financial industry, working and living in countries such as Singapore, Indonesia and Kenya.

Suhaimi holds an economics degree from the International Islamic University Malaysia (IIUM) and he is a qualified chartered professional in Islamic finance. He also holds a certificate in Islamic law recognized by IIUM and attended the Global leaders Programme at Cass Business School in December 2019 held in London in the UK.

Niclas Nilsson

Founder and CEO, CapnovumNiclas Nilsson is the founder and CEO of Capnovum, a pioneer in horizon scanning and regulatory change management and consistently recognized as one of the world’s most innovative regtech companies.

Niclas is a passionate entrepreneur with over 20 years of experience in financial services, and is a frequent speaker, panelist and lecturer on artificial intelligence, innovation, regulatory compliance, conventional and Islamic regtech, fintech and insurtech. Niclas co-authored the chapter on Islamic regtech for ‘The RegTech Book’ (2019), and advises boards of financial institutions on strategy, governance, data, technology and change.

Nitish Bhojnagarwala

Vice-President – Senior Credit Officer, Financial Institutions Group, Moody’s Investors ServiceNitish Bhojnagarwala is a vice-president–senior credit officer with Moody’s Financial Institutions Group. Based in Dubai, Nitish covers a portfolio of large conventional as well as Islamic financial institutions in the Middle East, Africa and Turkey.

Nitish joined Moody’s in 2011, and has led Sukuk roundtables and conducted workshops on banking and Islamic finance at various conferences in the Middle East, Europe and Asia. Nitish has also authored several research pieces, with a focus on regional banking, credit issues and issuer-in-depths for conventional as well as Islamic banks.

Prior to joining Moody’s, Nitish spent five years at Tamweel in the Treasury. He has also worked for KPMG in the UAE, where he covered financial institutions. Nitish holds an MBA from S P Jain Institute of Management & Research, with a major in finance (investment banking).

Professor Dr Nurdianawati Irwani Abdullah

Department of Finance, Kuliyyah of Economics and Management Sciences (KENMS), International Islamic University Malaysia (IIUM)Professor Dr Nurdianawati Irwani Abdullah is a professor in laws and Shariah at the Department of Finance, Kuliyyah of Economics and Management Sciences, International Islamic University Malaysia (IIUM). She is also the deputy chairman of the Shariah Advisory Board of AmMetlife Family Takaful, a member of the Shariah Advisory Board of Affin Islamic Bank Malaysia and a Finance Accreditation Agency-certified assessor and trainer. Previously, she was the chairman of the Shariah Advisory Board of Standard Chartered Saadiq Bank Malaysia (2008–17), a research fellow at the International Shari’ah Research Academy in Islamic Finance focusing on Takaful research, a visiting professor at the Malaysia University Kelantan and a Shariah consultant for ARSA Shariah Advisory Services and AFTAAS Shariah Advisory Services. She had served the Association of Shariah Advisors in Islamic Finance Malaysia and IIUM Institute of Islamic banking and Finance as a board member since establishment.

Professor Dr Nurdianawati holds a Bachelor of Laws degree, a Bachelor of Laws degree in Shariah and a Master of Comparative Laws degree from the International Islamic University Malaysia, and a PhD in Islamic banking and finance from Loughborough University-Markfield Institute of Higher Education in the UK. She has been committed in conducting training in areas related to legal and Shariah issues in Islamic financial products, Shariah governance, regulatory framework of Islamic finance and Takaful. Apart from that, she is directly involved in the legal working committee for the Ministry of Domestic Trade, Cooperatives and Consumerism together with the Association of Islamic Banks of Malaysia in respect to the legal reforms. Given her involvement and contribution to the Islamic finance education, research and consultancy, she was listed as among the ‘World’s 50 Most Influential Women in Islamic Business and Finance’ in 2017 and 2018 by the Islamic Finance Review Special Report. In 2019, she was awarded as one of the ‘Top 50 Most Influential Women in Islamic Finance’ and ranked at 34 recently in 2020 by the Cambridge International Financial Advisory.

Rafiza Ghazali

Director, Digital Banking, KAF Investment BankRafiza Ghazali is with KAF Investment Bank as the director of digital banking. She joined KAF Investment Bank to spearhead the project team for the incorporation and operational readiness process of the Islamic digital bank entity of the consortium being led by KAF Investment Bank.

Prior to joining KAF Investment Bank, Rafiza was group CEO of Cradle Fund, where she collaborated closely with the Ministry of Science, Technology and Innovation and the Ministry of Finance, tasked with supporting and developing Malaysian start-ups and tech entrepreneurs.

Rafiza’s wealth of experience in innovation and the digital economy makes her uniquely positioned to drive the digital bank value proposition at providing a conducive open-banking platform-based ecosystem to customers and partners.

Rafiza’s academic career includes a Bachelor of Science Economics in Accounting and Finance degree from The London School of Economics and Political Science and a graduate diploma in applied finance and investment majoring in corporate finance from the Securities Institute of Australia. She is also a fellow member of the Chartered Accountants Australia & New Zealand. She also graduated from the Said Business School at the University of Oxford with a postgraduate diploma in strategy and innovation.

Raja Shahriman Raja Harun Al Rashid

Senior Vice-President, Risk Management and Compliance, CagamasFor over 20 years, Raja Shahriman Raja Harun Al Rashid has been overseeing a wide variety of banking operations particularly on the governance, risk management and compliance pillars. Currently, he is heading the risk management and compliance function of Cagamas.

Raja Shahriman began his career with RHB Bank before joining Bank Negara Malaysia (BNM) where he gained extensive exposure in micro supervision and macro surveillance in ensuring the safety and soundness of several financial institutions under his purview. After a decade with BNM, he joined Deloitte Malaysia as the enterprise risk services director, then Hong Leong Bank heading its compliance function and thereafter SME Bank serving several positions as chief risk officer, chief internal audit and COO.

Ritesh Agarwal, Director

Director, Debt Capital Markets, Emirates NBD CapitalRitesh joined the DCM team at Emirates NBD Capital in September 2014. Previously, he worked at Bank of America Merrill Lynch, Mumbai office in the Capital Markets team where he helped numerous issuers raise both equity and debt.

He is currently responsible for origination, structuring and execution of Debt Capital Markets solutions (conventional and Islamic) for clients across sovereigns, supranationals, financial institutions and corporates. He has helped clients across GCC, Asia and Africa raise over USD 50bn across senior secured, unsecured and hybrid instruments in public/ private format.

Ritesh holds an MBA from Indian Institute of Management, Ahmedabad (India).

Rozani Osman

Senior Financial Sector Specialist, The World BankRozani Osman is presently a senior financial sector specialist with the Finance and Markets Global Practice of the World Bank, Kuala Lumpur. He works on several areas including climate finance, capital markets, financial sector development and financial stability monitoring in the East Asia Pacific region. Prior to working with World Bank, he was the head of treasury and liquidity management at Khazanah Nasional for 10 years. He is experienced in climate finance, treasury, capital markets and asset and investment management. He has an MBA from Cornell University and a Bachelor of Science degree in electrical engineering from the University of Virginia.

Ruslena Ramli

Director, Islamic Digital Economy, MDECRuslena Ramli is an Islamic finance advocate with 20-plus years of experience. Her banking repertoire includes corporate strategy and advising on Sukuk/bond issuances, as well as the development of Islamic banking products. She is an avid speaker in local and international Islamic finance conferences.

Ruslena brings to MDEC her expertise in Shariah compliant structures and established relationships with Islamic finance communities locally and abroad. Ruslena holds a Bachelor of Arts (Honors) degree in accounting and finance from Middlesex University of London and a Master’s degree in Islamic finance from the International Centre for Education in Islamic Finance.

Saify Akhtar

Director of Strategy, Pertama DigitalSaify Akhtar is an executive with extensive entrepreneurial experience at all stages of building technology businesses. Specifically, he has expertise in identifying impending trends in the technology landscape and preparing these compelling solutions for entry into emerging markets like Southeast Asia.

Saify’s experience also includes attracting investments, both locally and internationally, toward high-growth technology opportunities in these same markets where 85% of the global population resides. Beyond capital, Saify is adept at facilitating international technology companies, including unicorn start-ups, to land and deploy their offerings in Southeast Asia. Saify was a strategic partner to both Uber (2014) and GrabCar (2015) to launch and grow their gig economy offerings in Malaysia.

Additionally, Saify’s alternative data for credit assessments business was handpicked by the UK Department of International Trade for relocation to London, where it expanded in collaboration with financial inclusion organizations in London, MENA and South Asia. While in London, Saify was a member of the select committee chaired by Baroness Sandip Verma (ex-minister of international development in the UK and chair of UN Women UK) to attract Middle Eastern investment into the UK, specifically for tech start-up ecosystems.

Prior to joining Pertama Digital as the director of strategy in 2021, Saify consulted for

established businesses in London, Nigeria and Singapore on their digitalization strategies.

Vineeta Tan

Managing Editor and Director, Islamic Finance newsVineeta Tan is the managing editor and a director at REDmoney Group, one of the world’s longest-running Islamic finance media houses. Vineeta oversees REDmoney Group’s stable of products including Islamic Finance news, IFN Fintech and Islamic Sustainable Finance & Investment.

A multimedia journalist with over a decade of experience in the journalism and publishing industry working independently and leading a team, Vineeta specializes in ethical and Islamic finance as well as fintech reporting and analysis, covering regions including the Middle East, Asia, Africa and Europe.

As managing editor of IFN, Vineeta is responsible for the editorial direction and business development of IFN and its sister publications in addition to authoring reports, producing podcasts and conducting video interviews. She has interviewed senior industry players, key stakeholders and senior dignitaries including the finance/economic ministers of the Ivory Coast, Sri Lanka and the Maldives, among others.

Vineeta is a regular on the international conference circuit as both a moderator and speaker. She has an MBA and is trained in journalism and sociology. Vineeta also holds the Islamic Finance Qualification awarded by the Chartered Institute for Securities & Investments in the UK.

William Dale

Regional Vice President, Mambu APACWilliam Dale (Will) is the commercial director for Mambu APAC, and is responsible for driving the growth of the business across the APAC region. During his time at Mambu, Will has worked with a broad range of businesses, including neobanks, established Tier 1 banks and other fintechs and financial services institutions which now rely on the Mambu platform to provide banking, lending and BPaaS services for their customers.

Will brings 20 years of financial services expertise. During his career, he has managed large enterprise transformation projects and now leverages this experience to advise businesses on technology architecture design, business models and consumer product strategy.

Originally from Sydney, Australia, Will has spent the past 15 years in Asia and now resides in Singapore.

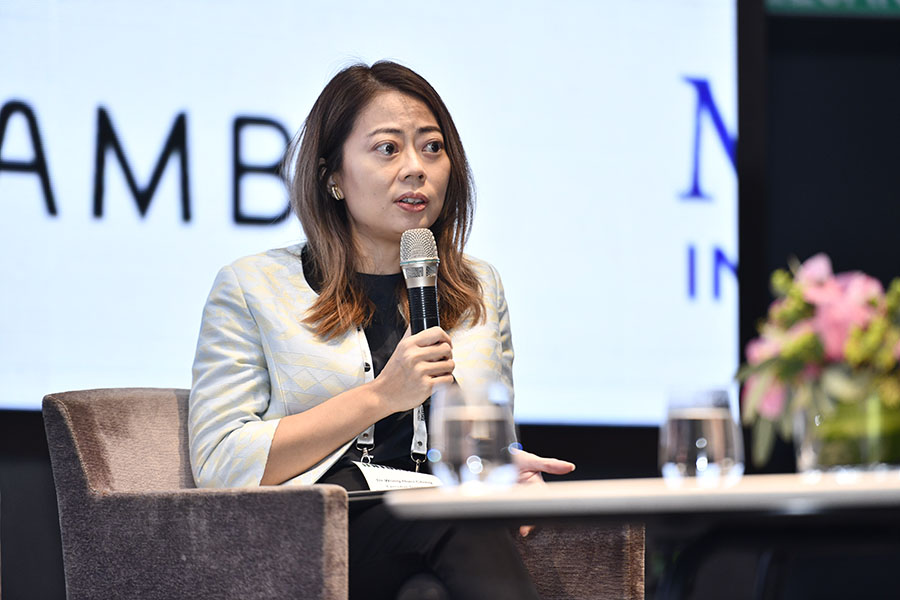

Dr Wong Huei Ching

Executive Director, Digital Strategy and Innovation, Securities Commission MalaysiaDr Wong Huei Ching is an executive director at the Securities Commission Malaysia (SC). She leads the Digital Strategy and Innovation Division, overseeing the Innovation, Digital Strategy, Analytics, Cybersecurity and Technology Departments.

Dr Wong’s appointment serves to further the potential of digital and innovation in the area of alternative fundraising and investments, toward shaping a capital market that is more inclusive and sustainable for business and investors.

Dr Wong joined the SC in 2017 and has been involved in various market development initiatives ranging from facilitation of market vibrancy to greater industry digitization efforts. She was also instrumental in the development of the recently launched Capital Market Masterplan 3. She is currently a member of the Labuan Financial Services Authority as appointed by the minister of finance.

Prior to joining the SC, Dr Wong was with a global management consulting firm as part of its strategy practice, and one of Malaysia’s largest banks. Her experience in the financial services sector spans consumer, wholesale and international banking, particularly in strategy development and transformation.

Dr Wong holds a Bachelor in Electronic and Communications Engineering degree and a PhD in electrical and electronic engineering from the University of Bristol in the UK.

Zahrain Zulkifli

Head of Commercial, CDX, Bank Islam MalaysiaZahrain Zulkifli is a digital transformation leader with nearly 20 years of experience in the technology arena. He has led the Digital Transformation Plan in Bank Islam and co-founded the Centre of Digital Experience, the division responsible for building Be U, Malaysia’s first Islamic digital bank. Prior to heading CDX’s commercial unit, Zahrain held various positions leading both business and product development teams in various tech companies such as Mesiniaga and Cognizant Technology Solutions. He is a certified design thinking practitioner and is very excited about innovation and customer centricity. CDX is designed as a customer-centric organization.

Zahrain’s passion for championing up-and-coming industry players further cements his position as a thought leader with heavy involvement in mentoring programs with several fintech start-ups. He is driven to steer the youth of tomorrow toward financial literacy and stability through technology and banking.