Adnan Zaylani

Assistant Governor, Bank Negara Malaysia

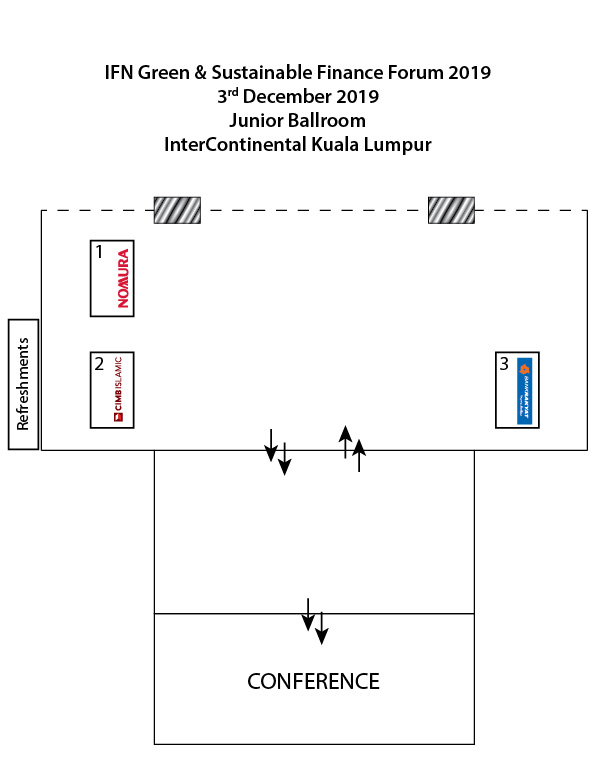

Date: 3rd December 2019

Day: Tuesday

ATTENDEES: 300

Venue: InterContinental Hotel, Kuala Lumpur

The United Nations Commission on Trade and Development (UNCTAD) recently estimated that in order to adequately fund the 17 Sustainable Development Goals (SDGs) in developing countries, US$5 trillion to US$7 trillion will be required in annual investments by 2030. Fulfilling this ambitious financial requirement presents not only challenges, but also significant opportunities.

The recent introduction of regulatory frameworks and initiatives promoting the development of sustainable finance across Southeast Asia has highlighted the significance and relevance of this important and fast-growing sector. With more corporates, financial institutions, government bodies and regulators becoming aware of Sustainable Development Goals, countries offering environments conducive for the growth of sustainable finance and investment will see tangible and long-term benefits.

Islamic finance plays an important role. Firstly, through the development of effective sell-side capital market products such as Green Sukuk in order to fund sustainable and humanitarian projects and initiatives. Secondly, to provide and channel investment from Shariah compliant asset managers and institutional investors to such initiatives.

This one-day event, developed by REDmoney Events, will focus on the opportunities presented by the growth of ethical, sustainable and responsible finance to the Islamic banking, finance and investment industry in Southeast Asia and beyond. Through a series of engaging keynotes, interviews and panels we shall explore how Islamic and sustainable finance can become more closely interlinked, and how Shariah compliant financial institutions and asset managers can play a greater role towards the achievement of Sustainable Development Goals, including the alleviation of disease and reduction of global displacement. We also examine how the Islamic finance industry can, through effective guidance and funding, help facilitate the development of key, strategic sectors, including education, healthcare, housing and agriculture.

09:00

Welcome Remarks

09:15

Keynote Address

Zainal Izlan Zainal Abidin, Deputy Chief Executive, Securities Commission Malaysia

09.30

Developing Sustainable Finance in Southeast Asia through Islamic Finance and Investment

Southeast Asia has the potential to become a global leader in the development and promotion of sustainable finance across a wide range of key sectors, including energy, agribusiness, healthcare and education. However, now is the time to push forward and build on existing achievements. What must governments, regulators and the private sector do to create effective responsible finance ecosystems and build toward the achievement of the UN Sustainable Development Goals such as the alleviation of disease and reduction of global population displacement? What role can the regional Islamic finance industry play?

Moderator:Prof Dr Obiyathulla Ismath Bacha, Board Member, Bank Kerjasama Rakyat Malaysia

Panelists:Chortip Svetarundra, Director, Bond Department, Securities and Exchange Commission, Thailand

Hussam Sultan, Regional Head, Commercial and Transaction Banking (Islamic), CIMB

Niels Knudsen, Deputy Resident Representative, Malaysia, Singapore, Brunei Darussalam, United Nations Development Programme

Dr Sutan Emir Hidayat, Director of Islamic Financial Education and Research, Komite Nasional Keuangan Syariah (National Committee of Islamic Finance)

Brought to you by

10.30

Coffee & Networking

11.00

Financing Renewable, Responsible, Social and Sustainable Projects

What role does Islamic finance play in the funding of green, sustainable, social and responsible initiatives and how available are Islamic facilities for these projects in reality? Through an expert panel, we analyze project uses, product structures, rating and reporting issues and ask how Islamic financial products can provide effective funding for sustainable and environmentally responsible projects and initiatives in Southeast Asia. What of other important strategic sectors: healthcare, housing, education and agriculture?

Moderator:Firoz Abdul Hamid, Advisor, Bank Kerjasama Rakyat Malaysia

Panelists:Chairil Nazri Ahmad, Head of Sector – Energy and Facilities Management, UiTM Holdings

Ernest Navaratnam, Group CEO, Cenergi SEA

Juniza Zahari, Director, Debt and Capital Markets, Affin Hwang Investment Bank

Rozani Osman, Senior Financial Sector Specialist, The World Bank

Sid Kusuma, Senior Vice-President – Head of Securitization, Sarana Multigriya Finansial

Brought to you by

12.00

Presentation: Corporations for Good – Democratizing Sustainability in Malaysia

Margie Ong, CEO, Thoughts in Gear

Download Presentation Slides

12.10

Environmental, Socially Responsible Investing and Islamic Investment: Opportunities for Development and Growth

We examine responsible investment in Asia and ask how ethical and Islamic finance can potentially become closer interlinked. We also discuss how Southeast Asia can grow its existing environmental, social and governance (ESG) niche among asset managers and owners and what role Islamic and ESG asset management can play toward achieving the UN Sustainable Development Goals. How can the industry overcome the relative scarcity of credible climate-related and low-carbon investment opportunities and what role do institutional investors play in the shift toward sustainable investments? Lastly, how can ESG risk, reward and impact be effectively measured and evaluated, and what benchmarks and tools are available?

Moderator:Margie Ong, CEO, Thoughts in Gear

Panelists:Alex Rowe, Portfolio Manager, Nomura Global Sustainable Equity, Nomura Asset Management

Azman Zainuddin, CEO, Quantum Solar Park

Hakan Ozyon, Senior Portfolio Manager, Global Ethical Fund

Simon Chen, Vice-President – Strategy and Business Management, Moody’s Investors Service

13:00

Luncheon

14:00

Finance, Technology, Innovation and Sustainability

What role do technology and innovation play in bringing together corporates, projects, asset owners and investors toward the growth of sustainability, responsible corporate finance and behavior?

Moderator:Vineeta Tan, Managing Editor, Islamic Finance news

Panelists:Bikesh Lakhmichand, CEO, 1337 Ventures

Raheel Iqbal, Managing Partner, Codebase Technologies

Shubhomoy Ray, Founding Partner, InfraBlocks Capital

14.45

Keynote Address

Adnan Zaylani, Assistant Governor, Bank Negara Malaysia

15:00

Keynote Interview: Financing Sustainable Energy in Malaysia and the Region

Interviewee: Dr Wei-Nee Chen, Chief Strategy Officer, The Sustainable Energy Development Authority (SEDA) Malaysia

Interviewer: Hatini Mat Husain, Senior Director/Head Debt Markets Advisory, Affin Hwang Investment Bank

15:30

HARD Issues: Making Sustainability Matter

Through a short, concise interview, we step outside the comfort zone and ask the tough questions the industry wants to hear.

Interviewee: Dr Simon Lord, Chief Sustainability Officer, Sime Darby Plantation

Interviewer: Ashraf Gomma Ali, Regional Head, Shariah Advisory and Governance/Positive Impact and Responsible Banking, CIMB Islamic

16:00

End of Forum

Dr Wei-Nee Chen

Chief Strategy Officer, The Sustainable Energy Development Authority (SEDA) Malaysia

Zainal Izlan Zainal Abidin

Deputy Chief Executive, Securities Commission Malaysia

Alex Rowe

Portfolio Manager, Nomura Global Sustainable Equity, Nomura Asset Management

Ashraf Gomma Ali

Regional Head, Shariah Advisory and Governance/Positive Impact and Responsible Banking, CIMB Islamic

Azman Zainuddin

CEO, Quantum Solar Park

Bikesh Lakhmichand

CEO, 1337 Ventures

Chairil Nazri Ahmad

Head of Sector – Energy and Facilities Management, UiTM Holdings

Chortip Svetarundra

Director, Bond Department, Securities and Exchange Commission, Thailand

Ernest Navaratnam

Group CEO, Cenergi SEA

Firoz Abdul Hamid

Advisor, Bank Kerjasama Rakyat Malaysia

Hakan Ozyon

Senior Portfolio Manager, Global Ethical Fund

Hatini Mat Husain

Senior Director/Head Debt Markets Advisory, Affin Hwang Investment Bank

Hussam Sultan

Regional Head, Commercial and Transaction Banking (Islamic), CIMB

Juniza Zahari

Director, Debt and Capital Markets, Affin Hwang Investment Bank

Margie Ong

CEO, Thoughts in Gear

Niels Knudsen

Deputy Resident Representative, Malaysia, Singapore, Brunei Darussalam, United Nations Development Programme

Prof Dr Obiyathulla Ismath Bacha

Board Member of Bank Kerjasama Rakyat Malaysia

Raheel Iqbal

Managing Partner, Codebase Technologies

Rozani Osman

Senior Financial Sector Specialist, The World Bank

Sid Kusuma

Senior Vice-President – Head of Securitization, Sarana Multigriya Finansial

Shubhomoy Ray

Founding Partner, InfraBlocks Capital

Simon Chen

Vice-President – Strategy and Business Management, Moody’s Investors Service

Dr Simon Lord

Chief Sustainability Officer, Sime Darby Plantations

Dr Sutan Emir Hidayat

Director of Islamic Financial Education and Research, Komite Nasional Keuangan Syariah (National Committee of Islamic Finance)

Vineeta Tan

Managing Editor, Islamic Finance news

Ashraf Gomma Ali

Regional Head, Shariah Advisory and Governance, CIMB Islamic Bank

Azleena Idris

Grand Council Member, Chartered Institute of Islamic Finance Professionals

Bilal Parvaiz

Director, Islamic Business and Product Management, Standard Chartered Saadiq

Cedric Rimaud

ASEAN Program Manager, Climate Bonds Initiative

Daud Vicary Abdullah

Managing Director, DVA Consulting

Hatini Mat Husin

Senior Director/Head Debt Markets and Advisory, Affin Hwang Capital

Lee Joo Wee

Head of Debt Markets, OCBC Malaysia

Margie Ong

CEO, Thoughts in Gear

Masumi Hamahira

Executive Advisor, Islamic Banking Window, MUFG Bank (Malaysia)

Dr Simon Lord

Chief Sustainability Officer, Sime Darby Plantations

Surendran Chelliah

Head, Group Risk Research, Maybank

Umar Munshi

Co-Founder, Ethis Ventures Malaysia

Forum Sponsors

MULTILATERAL STRATEGIC PARTNERS

PARTNERS

BADGE & LANYARD SPONSOR

For any inquiries contact us

Our team will be glad to answer any questions you may have about this event.