9.15 – 9.20

Welcome Address

9.20 – 9.30

Keynote Address

Khalid Hamad Al-Hamad, Executive Director – Banking Supervision, Central Bank of Bahrain

9.30 – 11.30

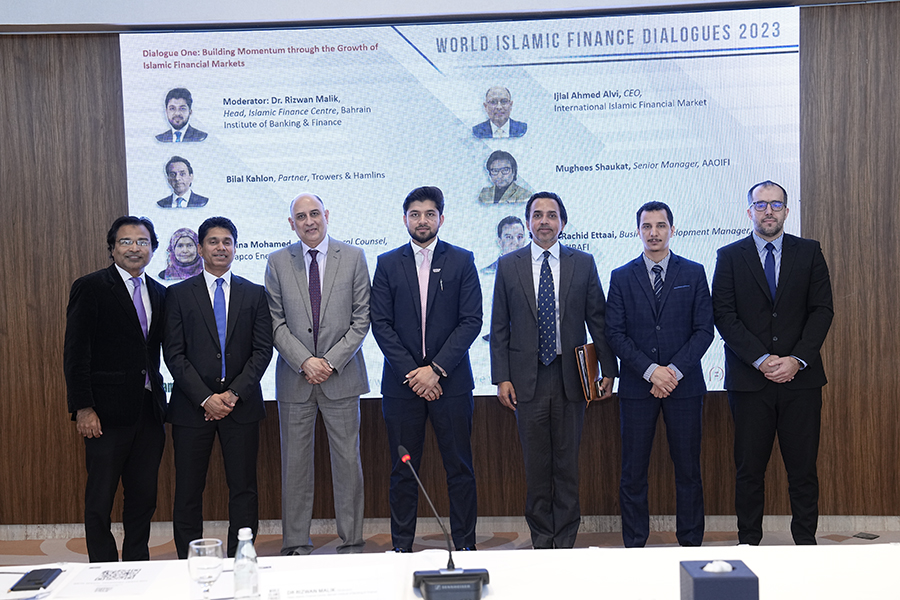

Dialogue One: Building Momentum through the Growth of Islamic Financial Markets

- What are the notable achievements and milestones of Shariah compliant financial and capital markets over the past year?

- How do regulatory environments influence the growth and development of the Islamic markets?

- Could amendments be made to market regulations, or could more be done by regulators? If so, what form would this evolution take?

- Developing the Islamic capital market: increasing market depth and liquidity, driving product innovation, and widening the investor base.

- Funding routes for corporates: Islamic capital markets versus bank funding.

- Ongoing innovation within Islamic finance markets: the scope for hybrid, perpetual, restructuring and syndicated transactions.

- How can Shariah compliant structures be further applied to the funding of clean energy projects and infrastructure?

- In the shift away from hydrocarbons, how can Islamic financial markets play a role?

- How can Shariah compliant transition, sustainable and sustainability linked finance and investment products be further incorporated?

- How do we continue to measure impact from green and sustainable issuance? What tools are available for issuers and investors for this purpose?

- What regulatory measures would adequately address and mitigate challenges such as greenwashing and reporting?

- Assessing the increasing influence of Waqf in fund and capital market structures.

- The growing prominence of Islamic P2P and equity crowdfunding, and the opportunities these activities offer.

Dr Rizwan Malik, Head, Islamic Finance Centre, Bahrain Institute of Banking & Finance

Panelists:Bilal Kahlon, Partner, Trowers & Hamlins

Elina Mohamed, Group General Counsel, Bapco Energies

Husain Sayed, CEO, Safaghat WLL

Ijlal Ahmed Alvi, CEO, International Islamic Financial Market

Mughees Shaukat, Senior Manager, AAOIFI

Rachid Ettaai, Business Development Manager, CIBAFI

Sabir Ahmed, Executive Director, Islamic Origination, Standard Chartered Bank

11.30 – 12.00

Coffee

12.00 – 14.00

Dialogue Two: Reaching New Heights - Innovation, Transformation and Digitalization of Islamic Financial Services

- What are notable milestones and key developments within Islamic banking over the past year, and what is the current outlook for the sector?

- How do prudential regulatory environments allow for the growth of Islamic banking?

- Could amendments be made to banking regulations, or could more be done by regulators? If so, what form would this evolution take?

- Do Tier-1 and Tier-2 Sukuk still offer Islamic financial institutions the most flexible and efficient way of satisfying regulatory capital requirements?

- Do we feel the same about AT1 issuances as we did before?

- What other funding options are open to Islamic financial institutions, and what liquidity management tools are available?

- The digitalization of Islamic financial services: what is working, what is not, and what this means for the evolution and transformation of Islamic financial services.

- Does the digitalization of Islamic financial services allow us to better address issues such as sustainability and product authenticity, and we are leveraging on this sufficiently?

- Are we sufficiently capitalizing on the powerful synergies between sustainable finance and Islamic banking, and how do we effectively position the sector?

- Is it feasible to require Islamic banks to incorporate ESG frameworks as part of a wider Islamic banking philosophy?

- How can Islamic banking be further applied to social impact initiatives through the advancement of education, housing, health, culture and well-being?

- Are Islamic financial institutions doing enough in the development of sustainable retail, corporate and commercial products?

- How do we continue to increase the market penetration of Takaful products?

Luma Saqqaf, CEO, Ajyal Sustainability Consulting

Panelists:Fawaz Ghazal, CEO, FLOOSS

Dr Gulnar Mulla, Senior Fellow of Department of Finance, University of Technology Bahrain

Hakan Ozyon, CEO, Hejaz Financial Services

Dr Shaher Abbas, CEO, IFIN Services

Tamer Al Maug, Managing Director, Codebase Technologies

14.00

Luncheon