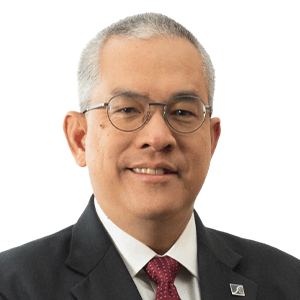

Dr Awang Adek Hussin

Executive Chairman, Securities Commission MalaysiaDr Awang Adek Haji Hussin was appointed the executive chairman of the Securities Commission Malaysia (SC) on the 1st June 2022. He is also the chairman of the board of governors of Universiti Sains Malaysia.

Prior to his appointment as the chairman of the SC, Dr Awang served as Malaysia’s ambassador to the US from 2014 to 2016 and chairman of Majlis Amanah Rakyat from 2017 to 2018.

Dr Awang has extensive experience in economics and finance, having spent over 30 years in government and public service. He served as the deputy minister of rural development from 2004 to 2006 and deputy finance minister from 2006 to 2013.

Dr Awang was with Bank Negara Malaysia for 17 years from 1985 until 2001, holding several positions and eventually rising to the rank of assistant governor. He has also served on the boards of directors of several financial institutions and organizations including the SC, among others.

Dr Awang received his Bachelor’s degree in mathematics and economics from Drew University in the US, as well as his Master’s and PhD degrees in economics from the Wharton School of the University of Pennsylvania in the US.