John Glen MP

Economic Secretary to the Treasury and City Minister

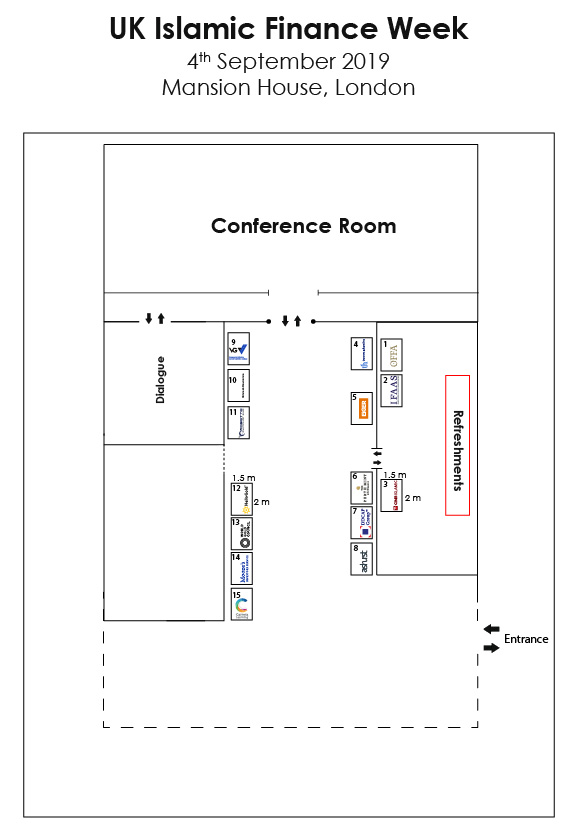

Date: 4th September 2019

Venue: Mansion House, London

Attendees: 488

Speakers: 70 Speakers

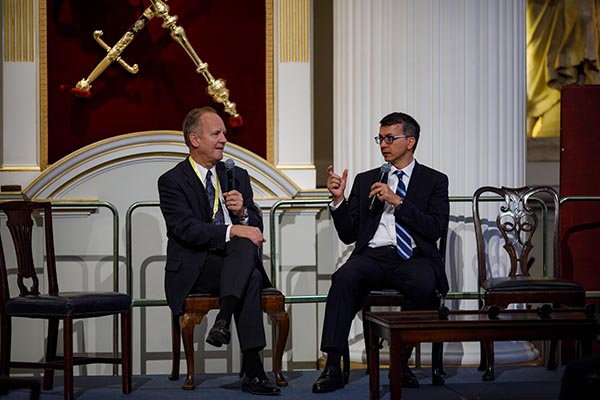

With six licensed Islamic banks and over 20 international banks offering Shariah compliant financial products, the UK’s Islamic finance industry is a favorite destination for investors, particularly for its flourishing real estate sector. Apart from the banking industry, the London Stock Exchange is also one of the most active Sukuk-listing destinations, with 67 listed Sukuk and three Islamic exchange-traded funds to date. On top of this, implications from Brexit has also led the Kingdom to boost its international trade and financial relationships with existing non-EU trade partners, especially with key Islamic finance markets from the regions of the Middle East and Southeast Asia.

Last year’s UK Islamic Finance Week saw many breakthrough sessions in a week-long event, including the official launch of iE5, an Islamic economy accelerator, during IFN Fintech Huddle UK. Following on from the success of 2018, IFN returns to London for the third time for various hard-hitting sessions and discussions in conjunction with leading European regulators, global standard-setters, world leaders and UK and European Islamic finance practitioners.

Amine Nait Daoud, Director-General, 570easi

DOWNLOADSheikh Bilal Khan, Chief Islamic Finance Officer, Astana International Financial Centre

WATCHWhat are key influencers for UK and European Islamic banking, asset management and capital markets in the coming year? What factors will drive the industry, what will provide opportunity and what will represent challenges? We ask a panel of industry leaders for their views.

Jawad Ali, Managing Partner – ME Offices, King & Spalding

Dr Usman Chaudry, Chief Risk Officer, Gatehouse Bank

Dave Matcham, Chief Executive, International Underwriting Association of London

Fabrice Susini, CEO, Saudi Real Estate Refinance Company

Stella Cox, Managing Director, DDCAP Group

How is the wave of technological innovation and digitization continuing to drive evolution in the UK Islamic financial services industry? Through an expert panel we look at Fintechs operating in traditional spaces such as retail banking, mortgage financing and property investment and discuss why this sector is so important in the drive for financial inclusion. What are the challenges still facing Fintechs in the UK and what can be done to help their funding and development?

Abradat Kamalpour, Partner, Ashurst

Abdulkadir Ali, Founder and CEO, Niyah

Cormac Sullivan, Senior Fintech Specialist, Fintech Hub, Bank of England

Gareth Lewis, Associate Director of Product, Eiger Trading Advisors

Mohamed Damak, Senior Director, Global Head of Islamic Finance, S&P Global Ratings

Niclas Nillson, Founder and CEO, Capnovum

Youness Abidou, Founder and CEO, Nester

France has the largest Muslim community in Europe which makes it a significant market for the Islamic economy. While Muslims are well served in most Islamic economic sectors such as Halal food, modest fashion, ethical travels and Islamic education, Islamic finance is one sector in which Muslims globally are still underserved despite high demand. With the boom of technology in financial services on one hand, and the unsteady economic environment on the other, we explore how it is now the best time to create synergies and build momentum.

Amine Nait Daoud, Director-General, 570easi

We cast a critical eye over the Islamic capital markets in Europe. Where’s the supply coming from and what can we expect in the coming year? We also examine how technology - particularly AI and big data - are disrupting how money is raised and managed.

Nitish Bhojnagarwala, Vice-President – Senior Credit Officer, Moody’s Investor Service

Mohamad Safri Shahul Hamid, Senior Managing Director and Deputy CEO, CIMB Islamic

Najib Al Aswad, Director, IFAAS

Robin Lee, CEO, HelloGold

Sharjil Ahmed, Co-Founder, Cykube

With SRI regulatory frameworks in place, the rise of stewardship, assets available – and in many cases fully Shariah compliant – responsible finance and investment has a bright future. Through an expert panel we examine responsible, humanitarian, environmental and green finance in Europe and ask how ethical and Islamic finance can become closer interlinked. We also discuss how Europe can grow its existing ESG niche among asset managers and owners and what role Islamic and ESG asset management can play towards achieving humanitarian and Sustainable Development Goals. Do green bonds and Sukuk offer viable long-term investments and how can the industry address the relative scarcity of credible climate related and socially responsible investment opportunities?

Lauren McAughtry, Contributing Editor, Islamic Finance News

Kristina Alnes, Senior Advisor, Center for International Climate Research – CICERO

Lydia Piddock, Head of UK Private Sector Partnerships, United Nations High Commissioner for Refugees

Martina McPherson, President, Network for Sustainable Financial Markets

Samina Akram, Managing Partner, Samak Ethical Finance

Simon Meldrum, Investment Specialist, Global Innovative Finance Team, British Red Cross

Sheikh Bilal Khan, Chief Islamic Finance Officer, Astana International Financial Centre

What is Waqf? How are Waqf typically structured, and what are the main variations? What are the challenges that Waqf face in making investments and accessing the financial markets? What solutions might be available?

Shibeer Ahmed, Partner, Winston & Strawn

Farmida Bi, Chair, Europe, Middle East and Asia, Norton Rose Fulbright

Hisham Daftedar, Senior Advisor, International Islamic Institute of Waqf

Sami Salman, Managing Director, International Islamic Institute of Waqf

Jaspar Crawley, Director, Institutional Investment, World Gold Council

John Durham, Manager – Depository, Gold Corporation, The Perth Mint

Philip Newman, Director, Metals Focus

We discuss the current environment in the UK and Western Europe for real estate investment and explore the continuing role played by Islamic finance. What are the latest trends, structures, themes and opportunities? We also assess the role technology plays and predict where disruption will be seen.

Sarah Gooden, Partner, Trowers & Hamlins

Asal Saghari, Counsel, King & Spalding

Hakan Ozyon, Senior Portfolio Manager, Global Ethical Fund

Mohamed Isarti, Head of Asset Management Europe, Wafra Capital Partners

Philip Churchill, Founder and Managing Partner, 90 North Real Estate Partners

Stuart Jarvis, Investment Director, Rosette Merchant Bank

Trevor Norman, Director, VG Trust & Corporate Services

Syed Zaid Albar

Chairman, Securities Commission Malaysia

Abdulkadir Ali

Founder and CEO, Niyah

Abradat Kamalpour

Partner, Ashurst

Amine Nait Daoud

Director-General, 570easi

Anne Plumb

CEO andHead of Underwriting, Cobalt Underwriting

Asal Saghari

Counsel, King & Spalding

Cormac Sullivan

Senior Fintech Specialist, Fintech Hub, Bank of England

Dave Matcham

Chief Executive, International Underwriting Association of London

Fabrice Susini

CEO, Saudi Real Estate Refinance Company

Farmida Bi

Chair, Europe, Middle East and Asia, Norton Rose Fulbright

Gareth Lewis

Associate Director of Product, Eiger Trading Advisors

Hakan Ozyon

Senior Portfolio Manager, Global Ethical Fund

Hisham Daftedar

Senior Advisor, International Islamic Institute of Waqf

Jaspar Crawley

Director, Institutional Investment, World Gold Council

Jawad Ali

Managing Partner – ME Offices, King & Spalding

John Durham

Manager – Depository, Gold Corporation, The Perth Mint

John Glen MP

Economic Secretary to the Treasury and City Minister

Kristina Alnes

Senior Advisor, Center for International Climate Research – CICERO

Lauren McAughtry

Contributing Editor, Islamic Finance News

Lydia Piddock

Head of UK Private Sector Partnerships, United Nations High Commissioner for Refugees

Martina McPherson

President, Network for Sustainable Financial Markets

Mohamed Damak

Senior Director, Global Head of Islamic Finance, S&P Global Ratings

Mohamed Isarti

Head of Asset Management Europe, Wafra Capital Partners

Mohamad Safri Shahul Hamid

Senior Managing Director and Deputy CEO, CIMB Islamic

Najib Al Aswad

Director, IFAAS

Niclas Nilsson

Founder and CEO, Capnovum

Nitish Bhojnagarwala

Vice-President – Senior Credit Officer, Moody’s Investor Service

Philip Churchill

Founder and Managing Partner, 90 North Real Estate Partners

Philip Newman

Director, Metals Focus

Robin Lee

CEO, HelloGold

Samina Akram

Managing Partner, Samak Ethical Finance

Sami Salman

Managing Director, International Islamic Institute of Waqf

Sheikh Bilal Khan

Chief Islamic Finance Officer, Astana International Financial Centre

Sharjil Ahmed

Co-Founder, Cykube

Shibeer Ahmed

Partner, Winston & Strawn

Simon Meldrum

Investment Specialist, Global Innovative Finance Team, British Red Cross

Stella Cox

Managing Director, DDCAP Group

Sarah Gooden

Partner, Trowers & Hamlins

Stuart Jarvis

Investment Director, Rosette Merchant Bank

Trevor Norman

Director, VG Trust & Corporate Services

Dr Usman Chaudry

Chief Risk Officer, Gatehouse Bank

Youness Abidou

Founder and CEO, Nester

Abdul Haseeb Basit

Co-Founder and Principal, Elipses

Charles Haresnape

CEO, Gatehouse Bank

Prof Emilio Escartin

Professor of Islamic Finance, IE Business School

Fara Mohammad

Legal Director, Clyde & Co

Farmida Bi

Chair, Europe, Middle East and Asia, Norton Rose Fulbright

Harris Irfan

Managing Director, Cordoba Capital

Hassan Waqar

Founder, MoneeMint

M Iqbal Asaria

Visiting Faculty, Cass Business School

Martina McPherson

President, Network for Sustainable Financial Markets

Natalie Schoon

Principal Consultant, Formabb

Natalie Dempster

Managing Director, Central Banks & Public Policy, World Gold Council

Shaykh Haytham Tamim

Founder, Utrujj

Sean Kidney

CEO, Climate Bonds Initiative

Stella Cox

Managing Director, DDGI

Tariq Al Rifai

CEO, Quorum Centre for Strategic Studies

Wayne Evans

Senior Advisor International Strategy, TheCityUK

FORUM SPONSORS

ASSOCIATE PARTNER

MULTILATERAL STRATEGIC PARTNERS

PARTNERS

IN ASSOCIATION WITH

MEDIA PARTNERS

Last Visit to London

Following on from the success of 2017, IFN Europe Forum once again returns to London – this time for a full week of activities in conjunction with leading European regulators, global standard-setters, world leaders and UK and European Islamic finance practitioners.

Working closely with the UK authorities and hosted in tandem with the UK government’s annual Global Islamic Financial Investment Group, the event will comprise a full one-day event covering all the latest developments and key topics in Europe’s Islamic finance landscape; along with a series of additional events, breakout sessions and focus groups throughout the following week to bring together leading practitioners and drill down into the nuts and bolts of doing business in Europe. Across an array of sectors from real estate and fintech to human capital, education and regulation, the Islamic Finance Week will shine a spotlight on the latest opportunities in the region and how to take advantage of them.

European markets have continued to demonstrate a strong commitment to Islamic finance with an emphasis on growing the Islamic investment industry. In addition to real estate investment funds, Europe is also a vibrant market for alternative investment funds, private equity, retail, hedge funds and SRI investing. While the UK has made strides forwards with its supportive regulatory environment, attractive Sukuk listing location and booming real estate market, other countries are also making their mark. Luxembourg continues to be a key platform for Shariah compliant funds while also pioneering the green finance movement, while France is making leaps and bounds in the Islamic fintech arena and Germany continues its headway into the retail banking space. And of course, the exclusive announcement from the UK government at IFN Europe Forum 2017 regarding the reissuance in 2019 of its GBP200 million (US$264.1 million) Sukuk refocuses attention on the European capital markets, and how they can leverage sovereign support to kick-start corporate issuance.

IFN London: Islamic Finance Week 2018 is expected to gather participants from across Europe, Asia and the Middle East and will encompass everything related to the continent’s growing Islamic finance industry, attracting a truly global audience with a focus on central issues and latest developments.

Imam Qazi 2015

The IFN Europe Forum 2015 was a fantastic event for networking and keeping up to date with the latest developments in our industry. It has built upon the success of previous years and is now an established date in the Islamic finance calendar. Luxembourg, in the heart of Europe, provided the perfect setting for the forum.

Robert Scharfe 2015

The IFN Europe Forum was a great occasion to gain a global overview of the dynamics developed in Islamic finance in Europe and beyond, be it on markets, on products or on investors’ behavior. The interaction with participants from the various home markets of Islamic finance is extremely enriching and helps us better focus our support to the industry.

Mohamed Damak 2016

I would like to thank you for inviting us to speak at the IFN Europe Forum held in Luxembourg. It was indeed a great pleasure to attend and speak at this well-organized – with a very good quality audience – event.

Stefano Padovani 2016

The IFN Europe Forum was an exceptional opportunity for gathering the most brilliant players in the European Islamic finance space. This was my third participation at the forum, which I think has been one of the best events in recent years for discussing the development of the industry across Europe. I enjoyed very much debating where Islamic finance is heading to in the region and globally with my fellow panelists and the questions from the floor as well and found the level of attendees impressive.

Ashraf Ammar 2016

First, I would like to thank REDmoney for its continuous efforts to promote and to support the Islamic finance industry all over the world. I was honored to participate in the annual IFN Europe Forum which took place in Luxembourg for the third consecutive year. As always, there were good quality speakers from different countries and regions with different business backgrounds, flying in to Luxembourg to share with the attendees their knowledge, experiences and best practices.

Annemarie Arens 2016

The IFN Forum provides a great platform to foster proximity between Islamic finance and more traditional financial sectors in Europe. The wide diversity of national and international attendees proves the growing interest for the wider sphere of ethical and responsible investments and its growth potential. The truly disciplined criteria of Shariah funds have a lot of similarities with the ESG criteria applicable to the LuxFLAG label, hence it was a great pleasure for me to participate as a panelist. For Luxembourg, as the European center of expertise in Islamic finance, it was an honor to host the conference for the third time.

Robert Scharfe 2016

It’s been refreshing to see the diversity of developments in Islamic finance products and markets in Europe as well as globally. IFN managed again to gather experts with very diverse backgrounds with the aim of confronting views and opinions in an open and constructive dialogue.

Angus McLean 2017

I thought the IFN Europe FinTech event provided an excellent platform to raise the profile and awareness of one of the fastest-growing areas of the fintech sector. As the sector continues to develop, this could become a key date in the Islamic fintech calendar.

Maisa Shunnar 2017

It was a great event with rich topics and a good crowd. I enjoyed being part of it.

Mike Rainey 2017

Great event in London on the 11th September 2017 organized by IFN. IFN does a great job of keeping the Islamic finance community together and ensuring the sector maintains high profile. Congratulations to IFN on the success of the event. I will definitely be back in 2018.

Richard Ellis 2017

REDmoney assembled a highly relevant panel to debate current issues in the commercial real estate investment market. We had a good discussion and had active engagement from the audience.

aly meghani 2017

I found the IFN conference both informative and thought-provoking. As an investment professional trained to focus on risk-adjusted returns, the conference provided a sensible argument and evidence to support ethical screening in the selection of investments, not just from an alpha/outperformance perspective but also from a responsible fiduciary perspective.

Majid Sadjadi 2017

Congratulations on a very successful event. I am pleased to have been able to speak.

Wayne Evans 2017

IFN Europe 2017 was a well-organized event with good speakers complementing an interesting and topical agenda. The debates were relevant with the numbers attending high. The audience and other participants were of good quality. The organizers are to be applauded for the arrangements and TheCityUK was pleased to have supported the event.

Marcus Peter 2017

It was a delight to once again have supported the REDMoney Europe event in 2017 well-organized, well-visited and a very interesting setup in London, returning there after having taken place in Luxembourg for some years. I only can recommend to participate also in 2018 regardless of whether venue will be in London or Luxembourg as the community and project volume of Islamic finance in Europe continue to grow.

David Testa 2017

I thought the event was well-attended, with a good deal of energy and useful insights into the key sectors of the current Islamic finance marketplace.

Abradat 2017

Very professionally organized event with an excellent turnout. I hope to contribute again next year.

Rachid 2017

First things first, I really need to thank you for your continuous support and for doing the utmost to make our participation at your event both seen and enlightened. Thank you so much! On ourside, we’re hoping to be continuous supporters of your venture that does so much to spread the word about Islamic finance

Muneer Khan 2017

It was a pleasure to take part and good to see the turnout and quality of attendance and discussions.

Duncan 2017

The IFN Dialogue was a very worthwhile session allowing regulators, government and practitioners to exchange views and opinions on the current state and future opportunities within the Islamic finance sector. Given the wide range of relevant discussions, I would support any proposal that this should be established as a regular meeting group.

HM GOV 2017

The IFN Europe Forum provided a useful platform for the ongoing dialogue between government, regulators and industry participants on how the Islamic finance industry may be encouraged to reach its full potential. The robustness of the discussions was testament to the key role the UK and its firms can and have to play in shaping the future direction of the industry both in the UK and elsewhere.

Ali Khokha-IFNUK18

I would like to confirm that the event was definitely a real success. I really appreciated the quality of the discussions and the importance of the topics selected for the different sessions.

Bruno Martorano-IFNUK18

Very much enjoyed the event. Looking forward to next year’s.

Mohamed Damak -IFNUK18

I enjoyed the event in London and I thought it was very well organized, with good speakers and a discussion that covered all the important subjects related to the global/UK development of the Islamic finance industry.

Marco Lichtfous-IFNUK18

As always it was a great event and very helpful for the whole industry. I enjoyed my participation a lot and am looking forward to supporting and participating in any future events.

Mark Hucker-IFNUK18

I really enjoyed the event and found it interesting and valuable. From a VG perspective, I was very pleased with the profile it gave us and the opportunity to catch up with clients and contacts.

Najib Al Aswad-IFNUK18

Indeed, I can’t agree more, I think IFN UK Islamic Finance Week 2018 was well organized and attended, offering an interesting mix of topics and discussions with many experts in different sectors of the Islamic finance industry. You may quote me on this if you want.

Nikhil Rathi-IFNUK18

I enjoyed the sessions and meeting other panelists during the event.

For any inquiries contact us

Our team will be glad to answer any questions you may have about this event.