JOIN US IN

About The Forum

Building on the success of the IFN Investor Middle East Forum, the IFN Investor Asia Forum will take place in Kuala Lumpur, the region’s heart of Islamic finance activities.

Featuring a stellar line-up of investment leaders, IFN Investor Asia Forum will canvass the Islamic investment and asset management landscape of Asia, bringing invaluable insights into market trends, wealth generation and product development.

As the industry evolve to adapt to new demand and risks, the region’s leading investment managers will guide us on how to understand and prepare for the changing regulatory landscape, identify opportunities in the region, and explore the potential and need for new instruments across various asset classes.

An Introduction to 2024

In 2023 we returned to a full in-person program, with record numbers at many of our events – a sign of normality returning to the events industry.

For 2024 we have curated a fantastic lineup consisting of our regular leading events, a return to some markets after a short hiatus, and the introduction of two intriguing Islamic investment events.

We run a mixture of Forums and Dialogues throughout the year, depending on what each market responds best to. Essentially, they’re very similar, with only the structure of the discussion being different. For a partner, there’s no difference.

Our focus remains on delivering the best experience possible for delegates, speakers and partners.

What to look out for in 2024:

- Awards Ceremonies: The IFN Awards are the most coveted in the industry and our two Awards Ceremonies in Dubai and Kuala Lumpur continue to gather the elite form the Islamic finance world.

- Investor Forums: New for 2024, these two large-scale Forums in Dubai and Kuala Lumpur coincide with the launch of our new IFN Investor platform and will provide the perfect setting to discuss and debate the rapidly developing global Islamic investment space.

- UK Forum: Europe’s largest, longest running and most influential Islamic finance event will again return to the glorious Mansion House, under the patronage of the Lord Mayor of London. A truly global event, with key focusses on investment flows, sustainable, product development and Fintech.

- Oman Forum: This is the only annual international Islamic finance event in the stunning Sultanate, and one not to miss if Oman is on your radar. Full regulatory support, and all local banks and intermediaries are in attendance.

- Qatar Dialogues: In partnership with the Qatar Financial Centre, we’ll continue the discussion on the development of Islamic finance in the State and its important role in the global markets.

- Asia Forum: Our flagship event, the IFN Asia Forum is the largest Islamic finance focused event anywhere. Covering all markets and sectors in the region, if Asia is in your plans, this event is a must.

- Indonesia Dialogues: Still the world’s largest Muslim population with massive potential, this is the only international Islamic finance event in the island nation. Opportunities are rife and we’re now witnessing seismic changes in the Islamic finance landscape.

- Turkiye Dialogues: Returning to Istanbul with a physical event for the first time since 2019, we’ve been following from afar the phenomenal growth and development of the Islamic finance industry in the Republic. There’s much to discuss and we’d be delighted if you joined us.

- Saudi Arabia: Saudi Arabia remains the world’s largest Islamic finance center and an important market for IFN. This marks our 12th KSA event where we'll be discussing and debating how the Kingdom can build on its dominance and the role Islamic finance will play towards Saudi Vision 2030.

- Bahrain: Rounding off the year again in beautiful Bahrain for the World Islamic Finance Dialogues, in partnership with the Central Bank of Bahrain, we’ll be reviewing the year just past, previewing the year ahead and discussing the global industry at large.

As always, all Forums will be recorded and posted online for all to view, and all events will be complemented by a comprehensive Post Event Review. .

We’re excited for the new year and look forward to welcoming you to our events and assisting in the continued global growth of the Islamic financial markets.

#IFNEVENTS2024

Forum Agenda

9.05 – 9.15

Keynote Address

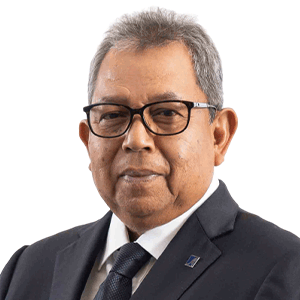

Dr Awang Adek Hussin, Executive Chairman, Securities Commission Malaysia

9.15 – 9.25

Presentation: Key Drivers for Regional Shariah Compliant Investment

9.25 – 10.30

Defining Islamic Investment in a Dynamic Market – Technology, Products and Markets

What represents a holistic and efficient Islamic investment ecosystem, and what is an effective regulatory environment to foster growth? What are notable recent developments in global Islamic investment management, including those influencing investment patterns, asset allocation and product innovation? How is technology changing Islamic asset and wealth management, and how is the emergence of private capital influencing the sector? Are suitable Shariah compliant savings and investment products being developed to meet local market needs? What Islamic investment trends have been witnessed in the Gulf that will have influence on the Asian markets? We ask an expert panel.

Panelist:Elias Moubarak, Partner, Trowers & Hamlins

10.30 – 11.10

Institutional Investor Roundtable

11.10 – 11.40

Coffee and Networking

11.40 – 12.40

The Power of Wealth: Harnessing Regional Opportunities in Islamic Wealth Management

What are the value propositions of Islamic wealth management businesses and products, and what is the size and demographic of the regional Islamic wealth economy? How are financial institutions refining the processes of wealth management to develop products, grow customer bases and build wealth management brands? How are balance sheets being used to transform and upgrade the mass affluent market into wealth management clients? Are Islamic financial institutions sufficiently leveraging on intergenerational wealth and the non-Muslim market, and are opportunities for cross selling wealth management services being capitalized on? We ask a respected panel.

12.40 – 13.00

Presentation: Social Impact Investing

13.00 – 14.00

Luncheon and Networking

14.00 – 14.40

Harnessing the Growing Influence of Shariah Compliant Private Capital

How is private capital influencing regional financial markets? How is private credit transforming Southeast Asian corporate financing, and what approach should regulators take? What are opportunities for private equity investment and how can this market be effectively navigated? What are opportunities for early-stage Shariah compliant venture capital, and can the success of global venture funds be emulated regionally? How have regional Islamic REITs and property funds performed and what is the likely evolution of these vehicles?

14.40 – 15.20

Innovation and Transformation Roundtable: Asset Management in the Age of AI

What are the key technological integrations and partnerships that are reshaping regional Islamic asset and wealth management, and how are regulators responding to innovation? How are AI and machine learning remodeling asset allocation and how is the implementation of tokenization set to change the industry?

15.20 – 16.00

Preserving our Future: Shariah Compliant Funding for Sustainable and Transition Projects

How is Islamic investment being channeled into energy transition and related technologies, such as hydrogen? How are innovative activities such as carbon trading driving sustainable investing, and what opportunities are presented by the carbon markets? How are investors encouraging portfolio companies to manage long term climate related risk and social impact? What is a realistic assessment of regional ESG guidelines and global taxonomies and their influence on Islamic investors? We seek the views of an influential panel.

16.00

Networking

Forum Keynote

Dr Awang Adek Hussin

Executive Chairman, Securities Commission MalaysiaForum Speakers

Advisory Board

Darius Nass

Associate Director, Global Equity Indices, S&P Dow Jones Indices

Eridani Tutiana Jusat

Head – Emerging Markets Fixed Income, Amundi

Dr Mohamad Zabidi Ahmad

Regional Chief Representative, DDCAP Group

Shahariah Shaharudin

President, Saturna MalaysiaRegistration

In The News

IFN Monthly Review: March — GCC Sukuk issuers keep momentum

Issuers in the GCC continue with the Sukuk trend, with notable launches from Abu Dhabi’s sovereign wealth fund and two...

Southeast Asian Islamic finance players: Agile and committed

A global Islamic finance powerhouse it may be, but Southeast Asia finds itself in a fast-moving environment with new asset…

60 years of Islamic finance: Malaysia’s winning formula

In September this year, Malaysia’s first Islamic financial institution, Lembaga Tabung Haji (TH), will celebrate its…

Chinese enterprise and Islamic investment association partner up to establish trading company

Don Hong Shi Dai Sichuan Industrial Co, a state-owned Chinese enterprise, has signed a joint venture agreement with Singapore-registered…

About REDmoney Events

REDmoney events designs, organizes and hosts industry-leading conferences, forums, roadshows, seminars and dialogues focusing on the Islamic financial markets across a global, regional and national level. Leveraging an exceptional network of the industry’s elite and supported by the expertise of the REDmoney publishing and seminars divisions, REDmoney Events are able to provide access to a unique array of influential speakers, panelists and participants from a cross-section of the global industry to debate the most significant issues affecting the Shariah compliant financial markets.

REDmoney events are differentiated by their complimentary yet qualified attendance structure, ensuring the highest quality of both delegates and contributors. Comprehensive and cuttingedge, attendance ensures exclusive access to the leaders in their field across all sectors and markets.

The annual IFN Asia and IFN UK Forums are categorically recognized as their continent’s leading industry events since their inception in 2006 and 2007, respectively. The Dialogues series have also become an integral element of the REDmoney events series and have cemented their position as leading, must-attend, events.

In 2024, we welcome the IFN Investor Forums, which coincide with the new IFN Investor portal.

For any inquiries contact us

Our team will be glad to answer any questions you may have about this event.