Building Momentum: Opportunities in Kuwait

What implications will potentially higher global interest rates and oil prices have on Kuwait’s economy, and how will this influence the activities of domestic Islamic financial institutions? What is a realistic current assessment of today’s Kuwait’s Islamic financial services sector – where are the opportunities for growth? Will the domestic Islamic capital market continue to be dominated by sovereign and Tier-1 and Tier-2 regulatory issuance? How are stakeholders driving digitalization in the financial services industry, and what efficiencies will innovation have for financial institutions and customers alike? Where does sustainability play a role in the funding of the Kuwaiti corporate and SME sectors, and will Islamic green finance and investment demonstrate notable growth in the country?

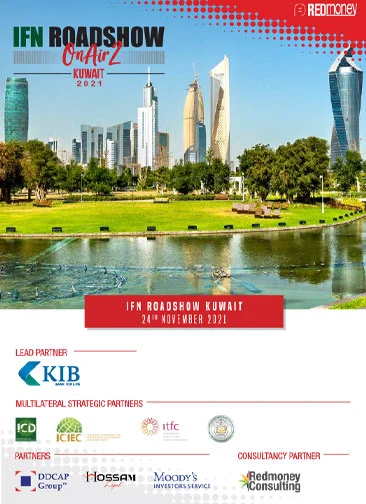

Moderator:Dr Issam Altawari, Founder and Managing Partner, Newbury Consulting

Panelists:Ajai Thomas, Chief Financial Officer, Kuwait International Bank

Ashraf Madani, Vice President, Moody’s Investors Service

Mourad Ali Mizouri, MENA region Senior Division Manager (Business Development), The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC)

Muhammad Ikram Thowfeek, Founder and Managing Director, MIT Global Group

Dr Scott Levy, Founder, Al Waseelah