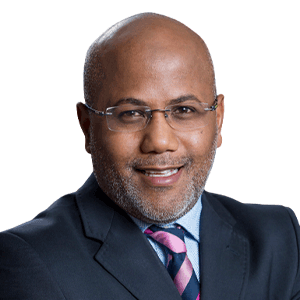

H.E. Talal Fouad Alhumoud

Deputy Governor for Investment, Saudi Central BankTalal Al-Humoud is the deputy governor for investment at the Saudi Central Bank. Prior to his current position, he had held various roles in the Saudi Central Bank including director of the Reserves Management Department and the head of external fixed income, among others.

Talal holds a Bachelor of Arts degree in economics the University of British Columbia and a Bachelor of Business Administration degree in finance from Simon Fraser University.