09:00 – 09:05

Welcome Remarks

09:05 – 09:20

Keynote Address

Zainal Izlan Zainal Abidin – Deputy CEO, Securities Commission Malaysia

09:20 – 10:10

Super Trends: Global and Regional Influencers for Islamic Finance and Investment

We examine and discuss key issues and themes influencing Islamic finance and investment in Asia, as well as significant other markets such as the Gulf and Africa. From regulation, to political risk to the ascendancy of fintech – what will offer opportunity and what will disrupt?

Moderator:Arsalaan Ahmed – CEO, HSBC Amanah

Panelists:Ashraf Mohammed – Assistant General Counsel, Asian Development Bank

Indar Barung – Head of Financing, Investment and Syndications, Sarana Multi Infrastruktur

Irwan Abdalloh – Head of Islamic Capital Market, Indonesia Stock Exchange

Mohammad Ali Allawala – CEO, Standard Chartered Saadiq

Rafe Haneef — CEO and Executive Director, CIMB Islamic

10:10 – 11:00

Fixed Income, Lending and Sukuk in Malaysian Capital Markets

What does the return of global volatility mean for Malaysian capital markets and what is an accurate evaluation of current investment and capital flows into and out of Malaysia? What are the prospects for local bond and Sukuk markets in a rising interest rate environment? What structures and asset classes will find favor with investors in a more volatile investment environment? We ask a leading panel for their views.

Moderator:Nicholas Edmondes – Partner, Trowers & Hamlins

Panelists:Charanjeev Singh – Managing Director, NewParadigm Capital Markets

Masumi Hamahira – Advisor, MUFG Bank (Malaysia)

Shamzani Hussain – Managing Director and Head of Islamic Banking – Corporate and Investment Banking, First Abu Dhabi Bank

Yeoh Teik Leng – Head, Structured Finance and Loan Markets, Capital Markets Group, AmInvestment Bank

11:00 – 11:30

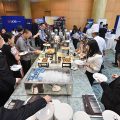

Coffee and Networking

11:30 – 12:10

Managing Risk and Rating Implications

Leading capital markets and investment management professionals discuss the lessons learned so far from the Dana Gas event and ask if Malaysia is immune to such an occurrence. We also examine the effectiveness of credit enhancement measures in the local fixed income market and discuss the associated rating implications.

Moderator:Khalid Howladar – Managing Director and Founder, Acreditus

Panelists:Azlin Ahmad – Senior Associate, Herbert Smith Freehills

Mohamed Damak – Global Head of Islamic Finance, S&P Global Ratings

Mohsin Shaik Sehu Mohammed – Head of Investment Banking and Capital Markets, Maisarah Islamic Banking Services, Bank Dhofar

Simon Chen – Vice-President – Senior Analyst, Financial Institutions Group, Moody’s Investors Service

12:10 – 12:45

Preparing for the Future: Financial Technology in Asia

What does the advancement of technology mean for financial institutions in Malaysia and the Asian region? What role will cryptocurrencies play in the global Islamic finance industry and will asset-linked coins feature in the corporate fundraising process? We assess the latest developments in fintech and analyze likely industry shifts, regulation and developments in product and delivery channels.

Moderator:Johnny Mayo – Business Consultant, SuperCharger Fintech Accelerator

Panelists:Abdul Rahman – Managing Partner, Abdul Rahman Law Corporation

Dima Djani – Co-Founder, ALAMI

Gopal Kiran – Fintech Advisory Lead – Malaysia, EY

Khairul Nizam – CEO, Financial Accreditation Agency

Robin Lee – CEO, HelloGold

12:45 – 14:00

Lunch & Networking

14:00 – 14:50

Today’s Funding and Capital-Raising Options for Issuers

What represents an effective capital-raising strategy for local issuers today, across all available product areas and markets? What more needs to be done to bring issuers to market, particularly for corporate issuance?

Moderator:Tahir Ali Sheikh – Director and Head Islamic Advisory, Client Coverage – Group Wholesale Banking, CIMB Investment Bank

Panelists:Chung Chee Leong – CEO, Cagamas

Faridah Bakar Ali – Director and CFO, Khazanah Nasional

Hazwan Alif Abdul Rahman – CEO, CMC Engineering

Lee Choo Boo – Executive Director, Quantum Solar Park Malaysia

Mohd Amri Sofian – Chief Corporate and Investment Officer, Danajamin Nasional

Yap Tse-Juie – Head of Finance, Alpha REIT Managers

14:50 – 15:00

Islamic Finance 2030-2050

Nik Norishky Thani – Executive Director/ Country Head Islamic Banking, UOB Bank Malaysia

15:00 – 16:15

Responsible, Sustainable and Green Finance Initiatives

What is driving the demand for sustainable, responsible and green financial products, and how can issuers tap this burgeoning market? Regulatory frameworks, innovation, pricing and placement: what are the factors for success and what are investors looking for? Where and how does green Sukuk play a role? How will governance-driven investment make its mark in Malaysia?

Moderator:Lawrence Oliver – Deputy CEO, DDCAP Group

Panelists:Daud Vicary Abdullah – Managing Director, DVA Consulting

Rozani Osman – Financial Sector Specialist, World Bank

Sharifah Bakar Ali – General Manager, Group Business Development, UEM Group

Simon Lord – Chief Sustainability Officer, Sime Darby Plantation

Stuart Hutton – Chief Investment Officer, Simply Ethical

16:15 – 18:00

IFN Fintech Huddle

A special value-added format gathering fintech experts in their own fields to take the stage in a 75-minute interactive open dialogue. The Fintech Huddle is designed to allow these thought leaders to dive deep, debate and dissect and take questions from the audience on the thorniest and most pressing issues the industry faces in the wake of the fintech revolution and identify where opportunities lie and how they can be best capitalized.

- What do investors look for when investing in Islamic fintech start-ups?

- What risks should be taken into consideration?

- Which verticals are most interesting?

- How is blockchain changing the game for Islamic finance?

- What are the latest blockchain-driven Islamic finance innovations?

- How have big data and AI changed the way Islamic financial institutions deliver services, engage clients and design products?

- Is the Islamic finance industry ready to fully embrace big data and AI and the changes that come with them?

- What needs to be in place for Islamic financial institutions to reap the full benefits of big data and AI?

- Is there a role for regtech in Islamic finance?

- How will it benefit the industry?

Johnny Mayo – Business Consultant, SuperCharger Fintech Accelerator

Panelists:Kyri Andreou – Co-Founder and Director, ATA Plus

Matthew J Martin – Founder and CEO, Blossom Finance

Muhammad Noor – Co-Founder, Rohingya Project

Niclas Nilsson – Founder and CEO, Capnovum

Robin Lee – CEO, HelloGold

Umar Munshi — Founder, Ethis Ventures

Wajahat Gilani – Investment Data Developer ,StrikeValuation

18:00 – 18:30

Coffee & Networking

18:30

End of Forum