|

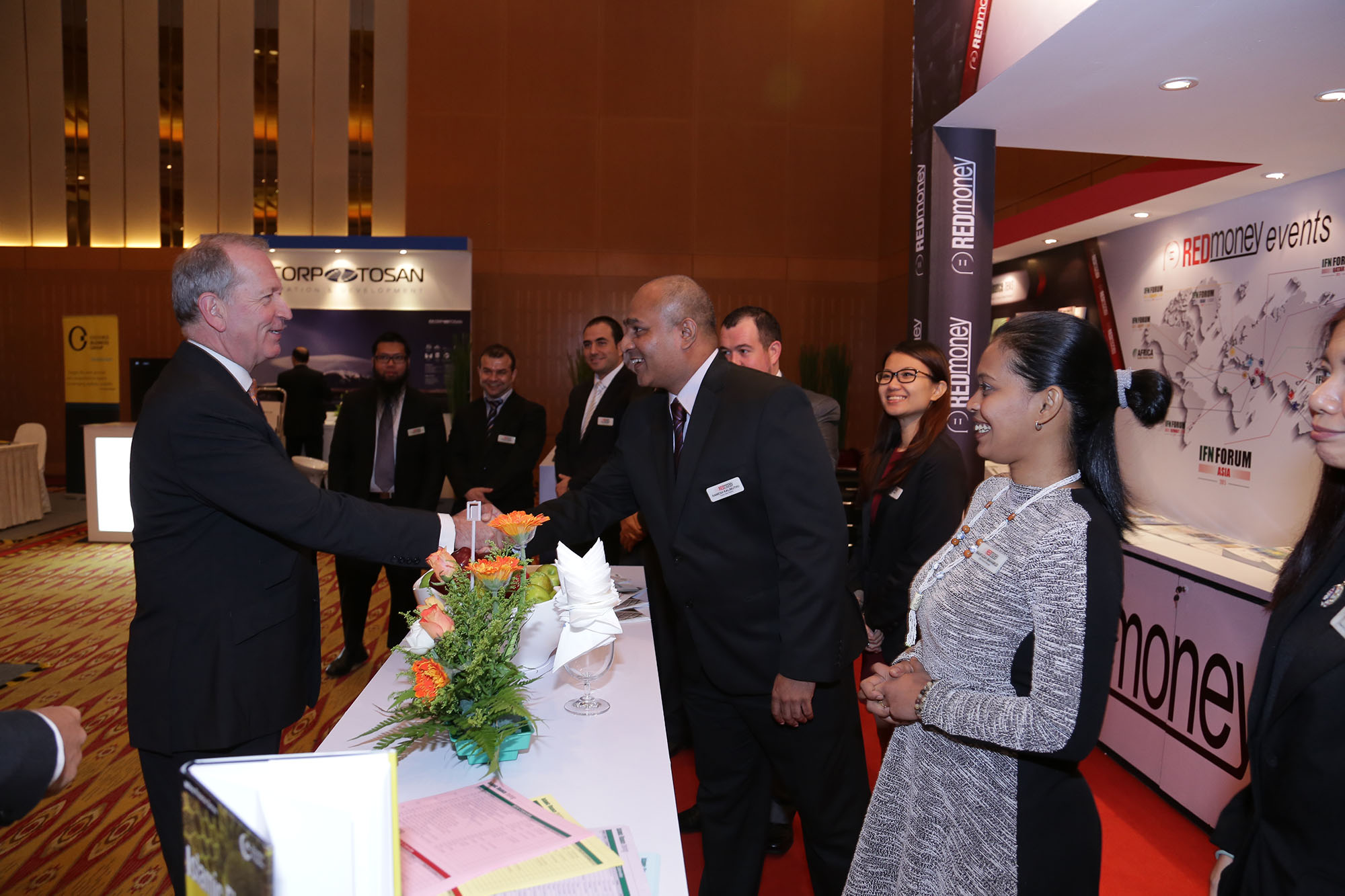

2015 marks the 10th year of REDmoney’s flagship event – the IFN Asia Forum. Known throughout the industry as the premier Islamic finance event in the region the forum consistently brings together the most influential market players and provides a platform to discuss the very latest issues affecting Islamic finance in the region.

As major Asian economies begin to seriously assess the prospects of Islamic capital raising the IFN Asia Forum will continue to deliver on its promise: to provide delegates with prospects, opportunities and current trends in mature and new Islamic finance markets in Asia.

The event will draw participation from speakers and delegates from Malaysia, Indonesia, Hong Kong, Japan Pakistan, Brunei, the Philippines, the Maldives and Sri Lanka amongst others.

Keynote Address by:

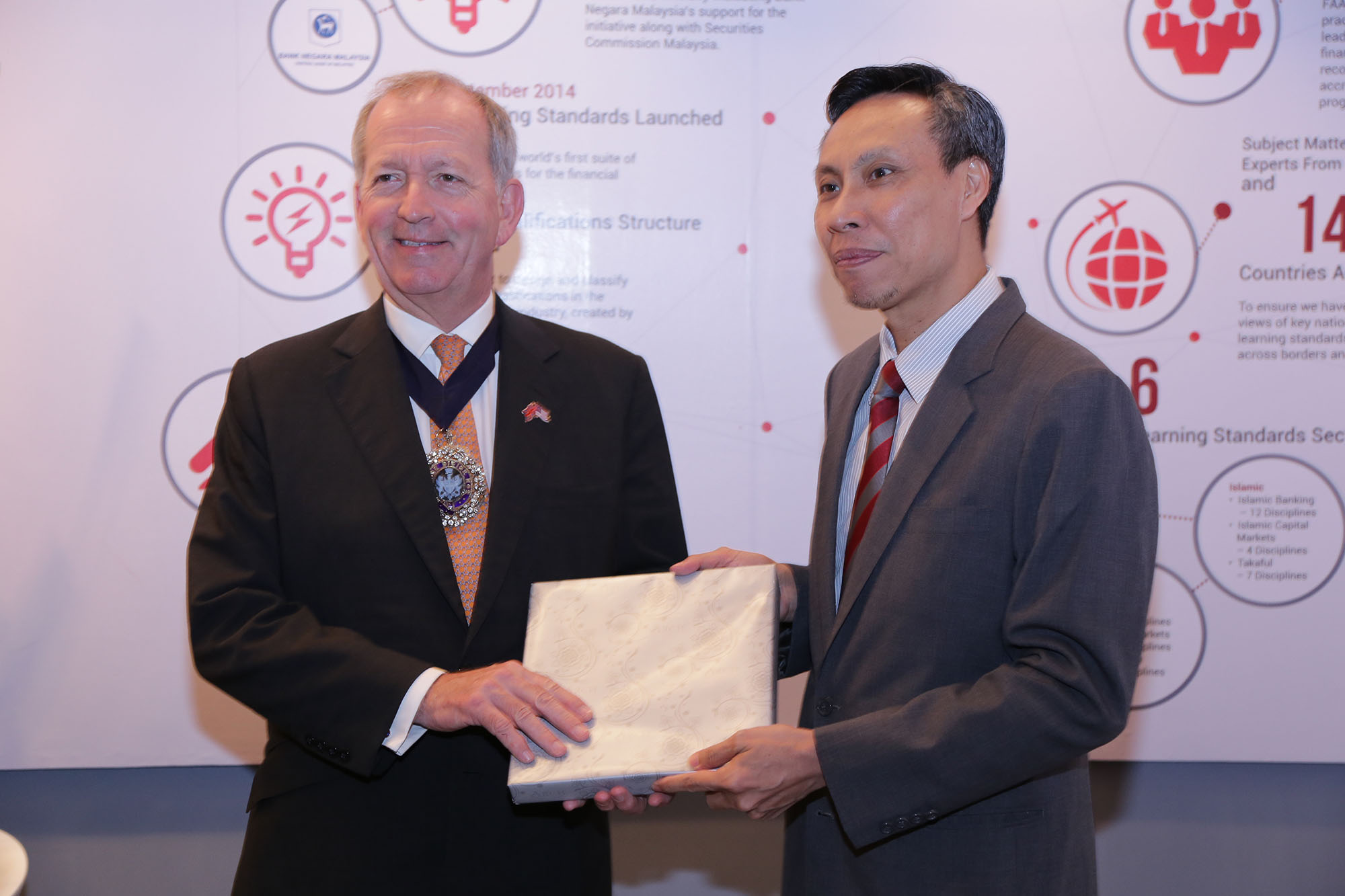

Alan Yarrow The Rt. Hon. the Lord Mayor of London |

Dato Dr Nik Ramlah Mahmood Deputy Chief Executive, Securities Commission Malaysia |

Professor Datuk Dr Rifaat Ahmed Abdel Karim Chief Executive Officer International Islamic Liquidity Management Corporation |

| Moderator: | Abdulkader Thomas – Chief Executive Officer, SHAPE Financial |

| Panelists: | Alex Armstrong – Managing Director & Head of Financial Institutions, QInvest, Qatar Jawad Ali – Managing Partner, Middle East Offices, King & Spalding, UAE Mohammad Kamran Wajid – Chief Executive Officer, Emirates Financial Services & Emirates NBD Capital, United Arab Emirates Mohamad Safri Shahul Hamid – Senior Managing Director and Deputy Chief Executive Officer, CIMB Islamic Professor Datuk Dr Rifaat Ahmed Abdel Karim – Chief Executive Officer, International Islamic Liquidity Management Corporation |

| Moderator: | Khalid Howladar – Global Head, Islamic Finance, Moody´s Investor Service, UAE |

| Panelists: | Chung Chee Leong – President/Chief Executive Officer, Cagamas Mohd Effendi Abdullah – Senior Vice President/Head, Islamic Markets, AmInvestment Bank Mohd Izani Ghani – Executive Director & Chief Financial Officer, Khazanah Nasional, Malaysia Promod Dass – Deputy Chief Executive Officer, RAM Ratings Qudeer Latif – Partner & Global Head of Islamic Finance Practice, Clifford Chance, UAE |

| Moderator: | Salman Ahmed – Partner, Head of Islamic Finance MENA, Trowers & Hamlins |

| Panelists: | Edward Gustely – Managing Director, Penida Capital Advisors, Indonesia Madzlan Mohamad Hussain – Partner, ZICOlaw Nik Norishky Thani – Senior Vice President & Head for Special Projects (Islamic), Group Chief Executive’s Office, Permodalan Nasional Berhad (PNB) Dr Shamsiah Abdul Karim – Waqf Scholar |

| Moderator: | Ahmed A. Khalid – Regional Head (Asia), Islamic Corporation for the Development of the Private Sector, IDB Group |

| Panelists: | Gregory Man – Partner, Norton Rose Fulbright Harish Parameswar – Managing Director & Head of Investment Banking, The Islamic Bank of Asia, Singapore Kemal Rizadi Arbi – Advisor, Capital Market Authority, Sultanate of Oman Naoki Nishida – President & Chief Executive Officer, Bank of Tokyo-Mitsubishi UFJ, Malaysia Norfadelizan Abdul Rahman – President Director, Maybank Syariah Indonesia |

| Moderator: | Abdulkader Thomas – Chief Executive Officer, SHAPE Financial |

| Panelists: | Ahmad Najib Nazlan – Chief Investment Officer, Amundi Malaysia Irwan Abdalloh – Head of Islamic Capital Market Development, Indonesia Stock Exchange Jamaluddin Nor Mohamad – Director of Islamic and Alternative Markets, Bursa Malaysia Ken Aboud – Partner, Allen & Overy, Singapore Michele Leung – Director of Fixed Income Indices, S&P Dow Jones Indices, Hong Kong Ritesh Maheshwari – Managing Director, Standard & Poor’s |

| Moderator: | Shireen Muhiudeen – Founder, Managing Director & Principal Fund Manager, Corston-Smith Asset Management |

| Panelists: | Hanifah Hashim – Executive Director & Head of Malaysia Fixed Income & Sukuk, Franklin Templeton Investments, Malaysia Dr Hasnita Hashim – Chief Executive Officer, Guidance Investments Maznah Mahbob – Chief Executive Officer, AmInvest Roslina Abdul Rahman – Managing Director, Amundi Malaysia |

Labuan IBFC’s International Waqf Foundation - The First Islamic Foundation Aimed at the International Market

| Panelists: | Dr Aida Othman – Labuan IBFC Specialist, Partner at Zaid Ibrahim & Co and Director at ZICOlaw Shariah Advisory Services Che Jamaliah Abdul Thahir – Head of Islamic Finance Unit, Labuan Financial Services Authority |

| Moderator: | Nicholas Edmondes – Partner, Trowers & Hamlins, Malaysia |

| Panelists: | Alan Yarrow – The Rt. Hon. the Lord Mayor of The City of London Dr Amat Taap – Chief Executive Officer, Finance Accreditation Agency Mohammad Faiz Azmi – Executive Chairman, PricewaterhouseCoopers, Malaysia |

| Moderator: | Lauren McAughtry – Managing Editor, Islamic Finance news |

| Panelists: | Leo Shimada – Chief Executive Officer, Crowdonomic Sam Shafie – Co-founder, pitchIN |

| Moderator: | Lauren McAughtry – Managing Editor, Islamic Finance news |

| Panelists: | Monem Salam – President, Saturna Malaysia Richard Thomas – Senior Advisor to the Board & Chief Representative, Malaysia, Gatehouse Bank Syed Abdul Aziz Syed Kechik – Chief Executive Officer, OCBC Al-Amin Bank |

| Moderator: | Abdulkader Thomas – Chief Executive Officer, SHAPE Financial |

| Panelists: | Ahmad Nazir Che Yen – Director, Group Islamic Banking, CIMB Islamic Azzizi Mohamad Ghazi – Managing Director, Ableace Raakin Cassim Docrat – Director, DDCAP Group, UAE Suzaizi Mohd Morshid – Senior Vice President & Head of Treasury, RHB Islamic Bank Tom Guest – Associate Director, Eiger Trading |

| Moderator: | Abdulkader Thomas – Chief Executive Officer, SHAPE Financial |

| Panelists: | Aderi Adnan – Director, Business Development, Labuan IBFC Angelia Chin-Sharpe – Chief Executive Officer, BNP Paribas Investment Partners Bishr Shiblaq – Head, Dubai Representative Office, Arendt & Medernach Chairil Mohd Tamil – Chief Business Officer, EXIM Bank Malaysia Gerald Ambrose – Chief Executive Officer, Aberdeen Islamic Asset Management |