The banking sector of Iran is fully Shariah compliant, making the Republic the leading Islamic banking asset holder in the world. The banking community has 45 banking institutions including nine investment banks, three government-owned commercial banks, five government specialized banks, 20 private banks, two Gharzolhasaneh banks and one binational bank.

Iran’s first Sukuk paper was issued in 1994, based on Musharakah and in 2016, the Iranian government debuted its Sukuk Ijarah. The outstanding amount of debt instruments in the capital market is valued at US$7.89 billion.

In May, the Securities and Exchange Organization established foreign exchange-denominated mutual funds, foreign currency-denominated debt securities and foreign exchange-denominated hedging instruments to prevent the future effects of volatility of the Iranian rial against the US dollar.

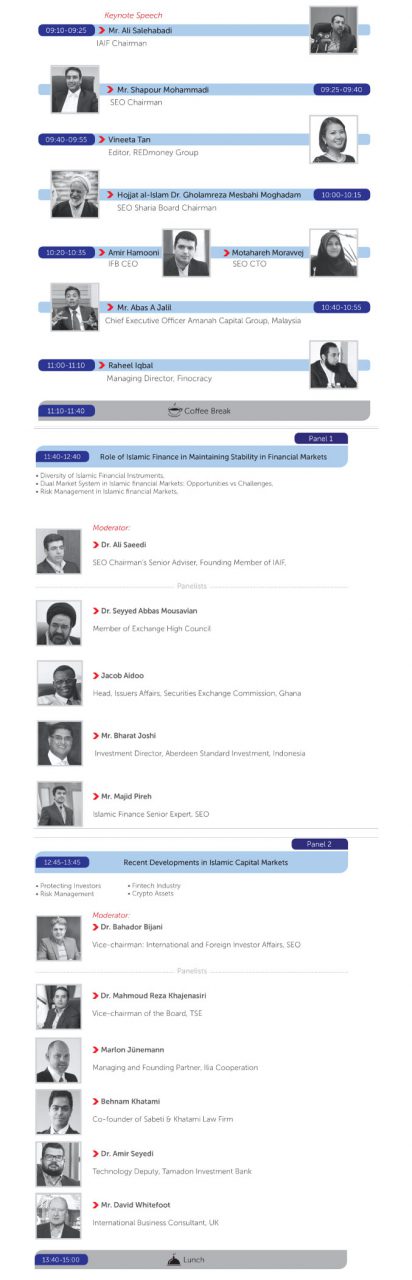

In partnership with the Iranian Association of Islamic Finance, we are delighted to announce the inaugural international Islamic finance industry-focused forum at Kish Island, Iran. Fully supported by the Iranian financial market regulators and participants, this half-day event will be conducted in English and will attract upwards of 250 of Iran's leading financial practitioners and regulators. This event is part of the larger annual Kish Invex, an international exhibition attended by all major financial entities including banks and capital market institutions.