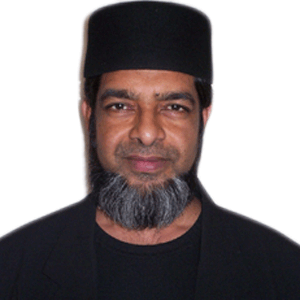

Dr Abul Khair Jalaluddin |

Dr. Abul Jalaluddin is currently a Director of Islamic Financial Services Council of Australia (IFSCA). He received his Ph.D. in financial economics from the University of Wollongong; Maser of Taxation Law from the University of New South Wales; Master of Economics (Honours) and Bachelor of Economics (Honours) degrees from the International Islamic University Malaysia. He has professional experience in income tax, indirect tax, superannuation guarantee, self-managed superannuation funds, taxation of Islamic finance, university level teaching and research. |

|

Almir Colan is a Director of Australian Centre for Islamic Finance (AUSCIF), Director at Awqaf Australia and Board member at Garden College. Almir is also an adviser to number of institutions that provide Islamic finance and member of a working group at AAOIFI. |

Almir Colan |

Ariff Sultan |

Ariff Sultan joined IdealRatings in 2012 as Regional Director - Asia and is responsible for the business in this region. IdealRatings is a solution provider for Islamic Capital Markets for Asset Management and also for the Responsible Finance / Environment, Social and Governance (ESG) sectors.

|

|

Chaaban Omran is a pioneer in Islamic Finance in Australia. Chaaban is the former Managing Director of MCCA, former CEO of Crescent Wealth, former COO Quordoba Investments where Chaaban was instrumental in the formation and development of their Australian Financial Services Licenses. Chaaban has a career in Superannuation & Investments spanning 25 years where he has worked at AMP, MLC, IOOF and Perpetual in senior capacities. Chaaban is the current CEO of the Islamic Financial Services Council of Australia and has been a regulator contributor to IFN News as the Australian correspondent. |

Chaaban Omran |

Christopher Aylward |

Christopher Aylward is a partner and head of Banking and Finance at Madison Marcus Law Firm based in Sydney. His practice area spans both conventional and Shari’ah compliant project, syndicated and trade finance, property and construction finance, as well as banking regulatory and foreign investment. He acts for borrowers, lenders and other transaction participants. |

|

Dale’s practice focuses on asset and structured finance, financial regulation and derivatives. He has acted on a number of Sharia compliant finance structures for banks, funds and sponsors in real estate and aviation deals in Asia and Australia. |

Dale Rayner |

HAKAN OZYON |

Hakan is a seasoned and successful leader with a track record of producing, presenting and managing the implementation of innovative business solutions. Highly motivated with a proven ability to develop people and commercialise all aspects of a business. Experienced in converting every opportunity into success and of driving profit and growth. Well networked within the Islamic community as well as the broader Australian community and highly successful in implementing business process improvements, defining company direction, achieving goals, change and optimising business procedures. |

|

Hilton has over 20 years of banking experience, working 15 years at Commonwealth Bank of Australia, a stint at Arab Bank Australia and in 2012 established the Sydney Representative office of Doha Bank. Hilton has held numerous positions, working across Operational, Product, Account Management, Sales and FI’s, roles including Global Head of Banking Partnerships, Head of International Business and to his current position as Chief Representative Officer. |

Hilton Wood |

Dr Imran Lum |

Imran is a Director of Islamic Finance in the Private Capital Markets team at the National Australia Bank (NAB). His primary responsibility is building the Islamic finance capability for bank's Corporate and Institutional Banking division. Prior to this, he was the national Product Manager for NAB’s multi-award winning Microenterprise Loans. Imran was appointed by the Foreign Minister to the Board of the Australia-ASEAN Council, Department of Foreign Affairs and Trade and he is an Advisory Board Member of the Islamic Museum of Australia. Imran is also an Honorary Research Fellow at the Institute for Religion, Politics and Society at the Australian Catholic University and the Founder of an online Arabic learning platform called arabicmadeinchina.com. In 2018, Imran was ranked in the top 500 who make the Islamic Economy by ISLAMICA 500. |

|

Issam is a Portfolio Manager in Sigma’s small capitalisation investment team and has 22 years of experience in equity markets. Prior to being a Sigma foundation director, Issam was a Director of Credit Suisse Asset Management, based in Sydney and an investment manager in the Small Cap Australian Equity Team. Issam joined Credit Suisse from ING Australia Ltd where he was the Head of the Small Companies Fund. Prior to ING, during his 11 years at Macquarie Bank Limited he held risk management, dealing and portfolio management roles for Equities, Property Securities and was the Head of the Australian Small Companies Team when he left in 2004. Issam holds a Bachelor of Business, Accounting, Economics and Finance from the University of Technology Sydney and is a Chartered Financial Analyst. |

Issam Eid |

Professor Dr John Hewson |

Dr John Hewson is one of Australia's most experienced economists, financial experts and company directors. He is also a former politician and was the leader of the Liberal Party and leader of the Opposition from 1990 to 1994. |

|

I have 16 years of customer service, high net worth customer acquisition & relationship management and sales of Islamic Banking as well as conventional products, customer and product portfolio management, service quality & process reengineering and customer service improvement projects from Standard Chartered Bank in Bangladesh and Singapore & The City Bank Ltd in Bangladesh. With these experiences in 10 different fields of Retail Banking Division, I have grown professionally equipped with hands-on involvement in acquisition, development and support of wide range of mainstream, Islamic banking as well as premium customer service & relationships and redesigning, repackaging & rewriting of products and processes. |

Mahanoor Hassan Khan |

Mohamed Hage |

Mohamed Hage is the Head of Research and Investments of CPG Research and Advisory. In this capacity, Mohamed oversees the investment research and strategy for CPG’s institutional and government clients. |

|

A brief biography of Dr Muhammad M Khan Dr Muhammad M Khan has been serving in various capacities primarily in the following areas:

In addition, Dr Muhammad M Khan holds a PhD (DU), MSc in Food Science & Technology (U of M) and M.Pharm and B.Pharm (Hons) in Pharmacy (DU) and has had a professional career working in both the food and pharmaceutical industry for many years. He worked as a research associate as well as in the research and development area in both educational institutes such as UWS and the food industry such as Dairy Farmers. He also successfully completed his MSc and full term Course on Introduction to Economics (1986-87), University of Manitoba, Canada. He has been an international speaker and delivered speeches in the provision of Halal food and Islamic finance in many countries and is currently the chairman and director of the BOD of Halal Australia Trust. He is also the chief executive officer of Halal Australia, a nationally and internationally recognised Halal food, meat, pharmaceuticals and consumables products certification body. Halal Australia is a member of the Australian Govt. accredited Halal Consultative Committee under DAFF-Biosecurity Export Control Act 2005 and its regulation for the red meat industry sector. Dr Khan was the consultant for one of the largest Airline catering companies, Alpha Flight Services, and on behalf of Halal Australia, he had developed a total Halal quality assurance program for (namely) Alpha Flight Services that caters halal meals for Royal Brunei Airlines, MAS, Emirates, Etihad and Qatar Airways (2004-2012). |

Dr Muhammad M Khan |

Muzzammil Dhedhy |

Muzzammil Dhedhy is an Islamic Scholar, Financial Adviser, Financial Counsellor and Mortgage Broker who is passionate about helping others build, manage, and protect their wealth, in an ethical and Sharia compliant manner. |

|

Dr Rashid Raashed |